Have you bought a car or a service that will be provided in the future? If so, they will have offered you, either online or by mail, a proforma invoice. It is a document that is used in many companies. and that we are still not clear about what it is for or when it is used.

If you are self-employed, offer online services, or if you buy products or services, you should know what a proforma invoice is, what it is like, when it is used, what distinguishes it from a normal invoice, and what it entails. for who issues and who receives one. Proforma invoice.

This little post will tell you everything you need to know about them, so in the end, you will know everything we have told you, and some other things that are equally important.

What is a proforma invoice?

TO The proforma invoice is a kind of draft of a normal and current invoice, but without having a book value.

It serves for promise future delivery of a product or service to a customer, which will subsequently be issued a normal invoice with the same data and amounts contained in the proforma invoice.

It is a commitment of the seller to the buyer that they will provide a product or service at a certain price.

As an example: a person in Jarandilla de la Vera is looking for a car online, an SUV, for example, the Nissan Juke.

He does not find any in the north of Cáceres, and he finds them, at an excellent price, in Alcalá de Henares, in Madrid, but he cannot go immediately, or the seller still does not have the car ready to deliver.

To ensure that the customer will have his car at the price he found, the seller or dealer sends him a Proforma invoice to ensure the price and sale of the car.

To end: it is a commercial commitment.

What is a proforma invoice for?

Many routinely mistake a proforma invoice for an invoice, but this is not the case.

Before you can clarify a little better what it is for, you should know that A proforma invoice has the same accounting validity as, for example, a quotation or a sales offerIn other words, it has no value for accounting purposes, so no proforma invoice issuance should be declared.

It serves more than anything so that both the seller as buyer is protected in case the price changes, or to ensure the value of a transaction, and is used not only in small purchases but also in international commercial operations of product quantities and large amounts of money, to document the value of transactions, or as models of sales offer.

For the buyer, it represents the security, as in the previous example, that his Nissan Juke will have at the agreed price, even when weeks have passed, and in that period the price has risen ... or fallen. What it does not represent for the buyer, is a guarantee in case the car turns out to be defective… for that the normal invoice, or the contract is used.

You have to be clear about the difference, and whether you are a seller or a buyer, never confuse the obligations and everything that a proforma invoice entails for what not, without ever confusing it with the invoice.

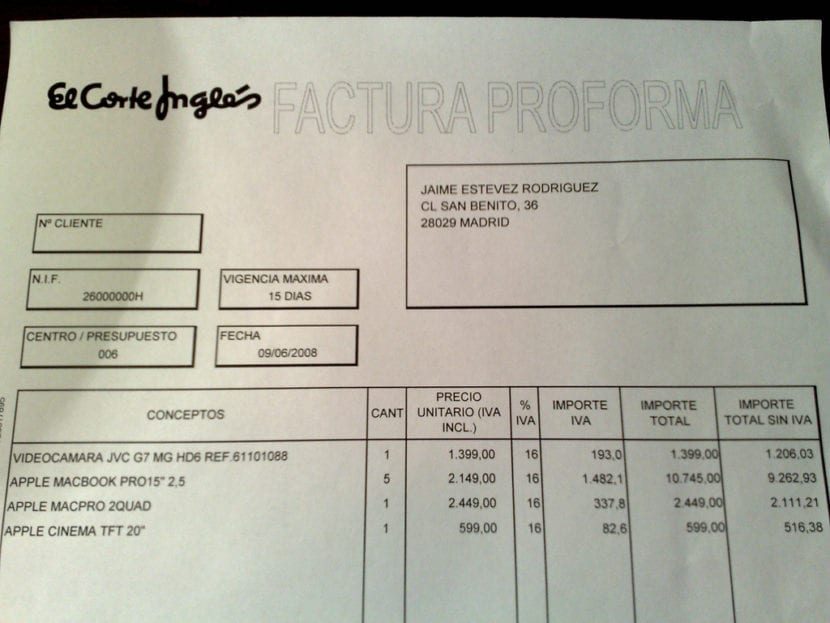

What does a proforma invoice contain?

The main reason why people often confuse a proforma invoice with a normal invoice, is that they contain the same data.

Practically the only difference is that the proforma invoice must clearly and visibly contain the title «PROFORMA"In the title of the document, and that may or may not be numbered or doubled as invoices.

The data that a proforma invoice must contain are the following:

- The title must have the title "proforma invoice", clearly and highly visible.

- The date of issuance of the proforma invoice.

- Provider details:

- Company name or company name

- NIF

- Contact information

- Community VAT number

- Customer data:

- Full name or company name

- NIF, DNI or NIE

- Contact information

- Clear and detailed description of the merchandise or services, clarifying the quantity or units of the product

- Unit price, total price and / or currency in which the transaction is carried out (rá)

- Insurance, transport, accessories, etc.

- Number of packages, gross weight, net and volume

- Payment method and conditions

- Document validity date

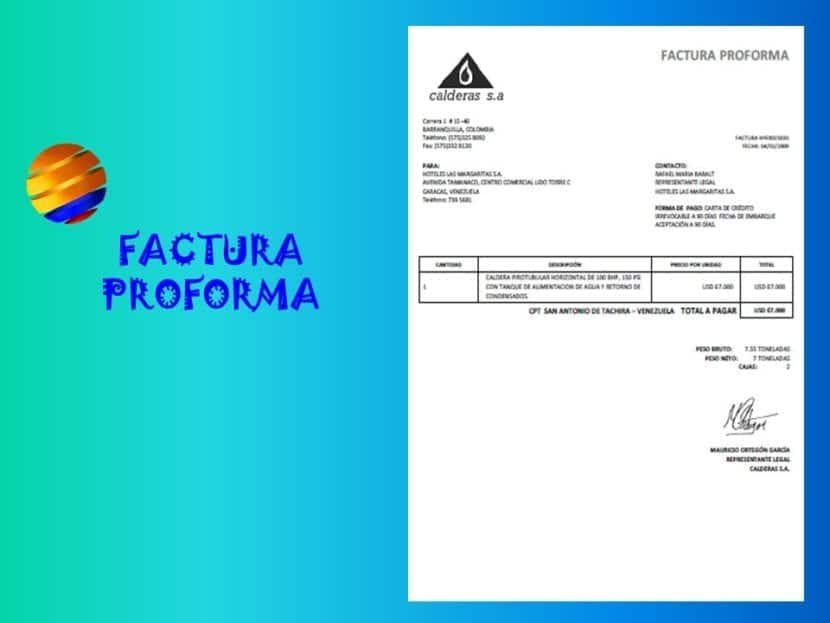

For international transactions, which is when they are most used:

- Tax identification number (in case of community operations)

- Request Reference

- Origin of the merchandise

- Transport

- Document validity date

Nor does it need to contain a company signature or stamp, unless the client requests the proforma invoice to be stamped.

What is the validity of a proforma invoice?

There is an obstacle to the validity of a proforma invoice.

Basically because its validity, as we have told you, does not transcend having a informative character or as a sales initiative, such as a sales quote or offer sent to a customer or prospect.

It does not serve as proof of payment, or to demand anything related to the invoice or as an accounting document.

So what is it for? It is only valid as a promise to respect the price of the products or services throughout the validity period contained in the proforma invoice.

It has no other validity of any kind, and is used more frequently in international transactions, both inside and outside the European Union, even though only the name of the document changes.

When can you use a proforma invoice?

Even though the main use is that of the promise to deliver a product or service, is not the only one that has, for practical purposes, not legal.

Imagine that you are not sure of the client's data, as an example you are missing the person's ID, and their fiscal address and you cannot communicate with the client, but you must send a document to the client, even when they have asked you for an invoice. .

Since it is not, for all practical purposes, valid, you can use it as a draft.

It sends it to your client, or you as a client receive it, with 'false' or example data, and if both agree, the client sends their correct data, accepts the prices and quantities and related expenses, then, now, yes, you can make the final normal invoice.

In other words, while serving as the delivery promise, it is a draft so as not to 'spend' normal invoices, something that, as you well know, you cannot emit like that because it is.

If you do not use proforma invoices, you must give them this use. If you are a client, you can request one to save time in case you want to think better about the viable purchase or contracting of services or products.

In addition, the supplier or the company may use the proforma invoice to save time in case you have run out of normal invoices. You can send yourself a proforma invoice so that the client has the promise of the delivery of a definitive invoice as soon as they have this document, so that when they have them again, they will not be affected by possible fluctuations in the price of the products. or services. bought.

Some examples in which proforma invoices will help you

Even though we have only mentioned some uses of the proforma invoice, it truly serves you for more things than you imagine.

We give you some examples in which proforma invoices will be of great help:

1.-International shipments

Proforma invoices are regularly used by customs, inside and outside the European Union to show the value of the merchandise to be transported.

2.- Subsidies and grants

Certain aids, such as those granted to the new self-employed, require the investment of certain amounts in the business, being able to present a proforma invoice to justify them.

3.- In financial operations

When someone requests a loan, be it a company or a private individual, the person or company is obliged to make certain investments, and to justify it as a guarantee or guarantee, the corresponding proforma invoices are presented.

4.- As a system of sections

Some companies use this document to "separate" certain products. As an example, if a customer does not have enough money or the supplier does not have the unit available, it can serve as a backup system to protect the volatility of the product.

5.- Sale offer

In short, we have mentioned it, but it is another use: sale offer. You can send sales offers in the form of a proforma invoice, at a discounted price to the one you offer to the rest, and from this dynamic you are obliged to respect the price within the term offered.

conclusion

A proforma invoice is the guarantee that this price will be valid for the period stipulated and has no accounting validity. or anything, it's just a promise, but you can use it as a draft and like many other uses, including in international transactions, especially in customs, inside and outside the European Union.