I just found out on the news that the employment crisis It has led many Spaniards to start their own business. Neither are the times to embark on the business adventure, despite everything it could be a more than interesting job possibility. Either through our savings, a small loan or through family aid, we need an economic contribution to start our project.

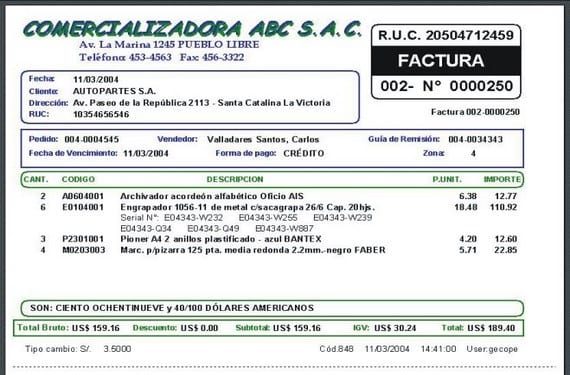

Among the comments to the news, one of the questions that potential entrepreneurs ask the most is that of bills that they have to broadcast. As freelancers this is one of the steps that we cannot miss, that is why we want to help you with some of the standard data that are essential when making these invoices.

- Name and surname

- Residential tax

- NIF

- Invoice number

- Invoice issue date

- Customer data (name and surname, company name, address, telephone number, NIF or CIF)

- Description of the assignment: the task carried out is briefly summarized)

- Price applied

- Taxable amount, or what is the same, the total to be charged

- VAT (general VAT is 21%) (if the invoice is made abroad, VAT must be replaced by VAT

- Personal income tax (-7% in the year of the first year as self-employed and in the following two years, or -15% in the remaining years. In addition, the 15% can be applied from the beginning, if desired)

- Total, the sum between the tax base + VAT + personal income tax

- Payment method

All of this data can be mailed in PDF format for convenience. To these data you can add the bank account to which to make the bank deposit, the commercial register of the company, contact telephone numbers and post office and guarantee or days in which the return is feasible.

All invoices must be well done so that there are no problems. To keep an order identification data of the self-employed and the company can be placed on top. Next, and on the other side of the top, we can place the data of the person or company to be billed. Next, and in the central part, we already include the concept of the service or product that is sold as well as the final cost of the service, the withholding of personal income tax and VAT, the total amount resulting from said operation and the payment form.

More information - Flat rate for entrepreneurs

Picture - Gecope system