It comes from the English term «Return on assets”, It is also known as «Return on investments» or ROI. It is one of the most important financial parameters today, today it is used by all companies that want to determine their cost effectiveness, The ROA, consists simply of calculate the bonding that exists between benefit obtained in a certain period and the assets global of a company.

Its relevance is mainly based on the fact that it enables check in In a direct way the degree of efficiency what provide the assets totals of a deal, without taking into account the financing alternatives used, as well as the load fiscal of the country in which the company does business. Rather, the ROA enables the finance manager to measure the capacity of the assets from a company to generate rent for they themselves.

How to calculate ROA?

The ROA parameter can be calculated with the following method:

ROA = EBIT benefits

_________________

Total assets

Perhaps it seems somewhat complex to understand, due to the terminology, to explain a little more its realization it is necessary to understand that the Benefits EBIT mentioned in the formula refers to those benefits obtained by the company before since to discount the interests, the taxes, and the Amortization.

In the second part of the formula, mention the Total assets, whose meaning corresponds directly to the average asset since two consequent balances.

The reason why EBIT It is used as a measurement factor to calculate the ROA, instead of using the profit after interest and taxes, it is mainly due to the generation of entry what Continue of assets Is absolutely independent of the load fiscal About him Benefits and the source of financing used are external factors.

East parameter indicates that options Have our deal with the assets that owns, in other words, how much profitability does each euro you've got invested in it, which is very useful when you want to make comparisons between various companies, as long as they are within the same sector, since the profitability of the investment varies depending on the sector very considerably. In very general terms, we can say that an index ROA greater than 5% that's all generating to to win significant.

It is then about the calculation of the Benefits Of a company, Go ahead Weighted average assets.

Where he benefit refers specifically to benefit have before of costs financial and the effect tax, while the asset should be averaged over the last two months as already mentioned.

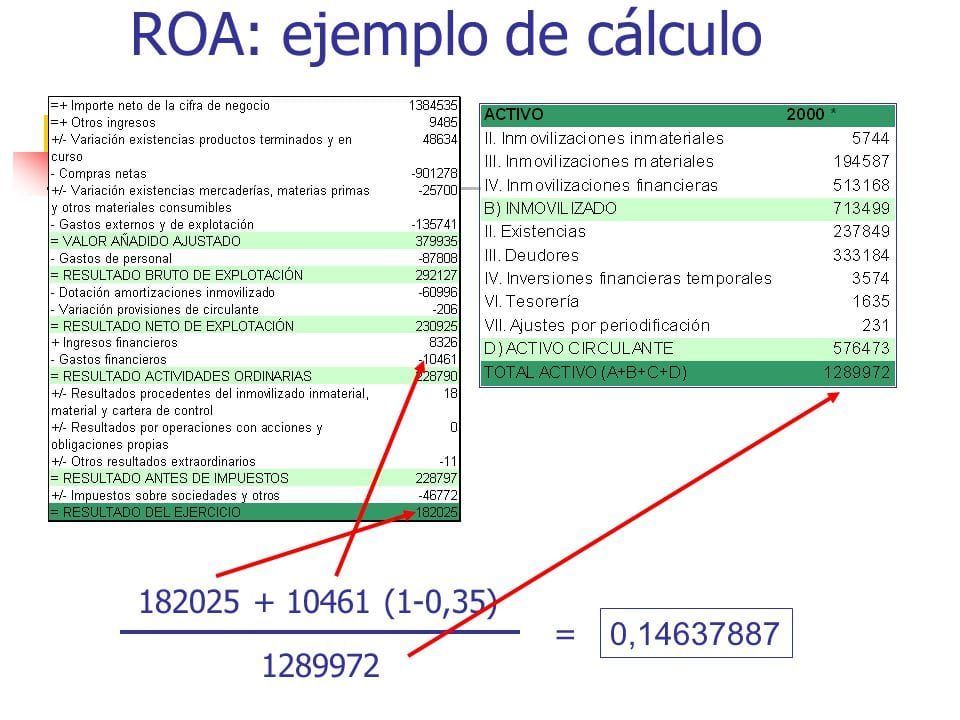

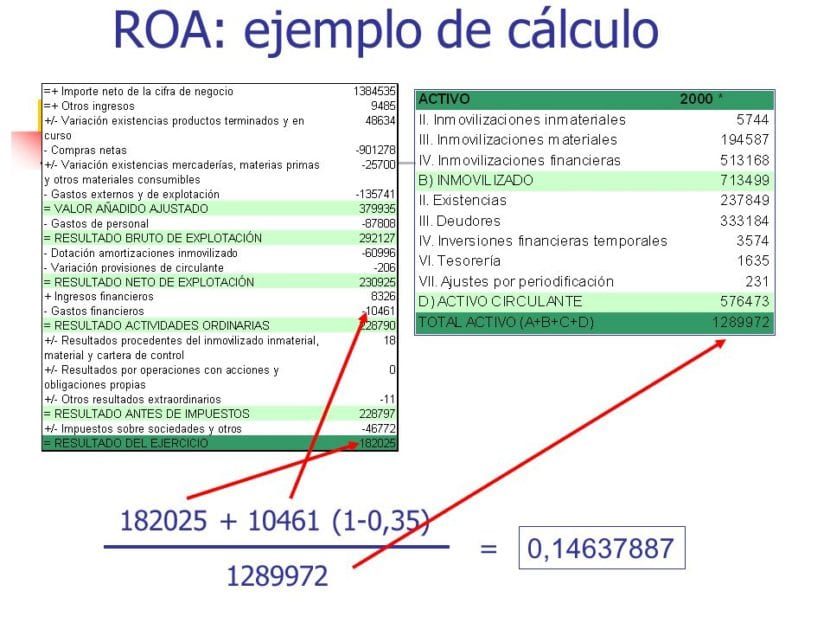

ROA calculation example

The first example is a company that manufactures parts, the ROA would be the accounting profit What is obtained from the exercise divided Between the assets of the business, these can be of: premises, machinery, money or stocks in inventory.

Through alternative you can get the ROA above the sales margin, as long as it is considered that:

ROA = Margin on sales X Asset turnover

Formula in which Margin on sales it is same toward:

Benefit

____________

Sales

And where the Asset turnover it is same for:

Sales

_________________

Average total assets

Continuing with the example of the company that manufactures parts, there are two different variables for calculate the cost effectiveness of the business, these are total sales volume and the margin achieved for each sale. This means that to achieve a profitability of the 10% for the spare parts company, there are two different ways to achieve it.

The first is to market 10 products with the benefit of a% and the second is to sell a single piece with a profit of 10%. With either of these two options the same result is obtained, the important thing is to firmly establish one for the destination of your business, depending of course on the price you obtain for obtaining the raw material, among other factors, if you do not get it. It has the lowest price, offers the best quality and charges for it, if it manages to market at a wholesale price, it must achieve large sales with little profit, which together will begin to generate a greater profit, as long as it has a team sales capacity.

ROA varies between different industries

Regardless of the sector to which the company belongs, a good ROA It is the one whose value exceeds 5%, even though this value tends to fluctuate depending on the industrial sector being analyzed. Because clearly a company in the metallurgical industry is not the same as a restaurant in the center of Madrid.

This is due to the initial investment to start the business, since, having a company with a higher initial investment of assets, will consequently have greater sales capacity and will be able to reach those customers who request high quantities of product.

On the other hand, if you start with a smaller amount of assets, the company will have to recover in sales, to be able to buy a little more each time, depending on the demand.

When you manage to get the assets at the best price on the market, when extracting or producing them, you have the option of controlling the demand for the product, an unethical action in my point of view, but very commonly carried out by large monopolies.

ROA facilitates comparison between companies

A very obvious example of its use for comparison between companies is, a company that has applied for a loan to finance its machines in a country with a very high tax burden, will have the same ROA than another country with a lower tax burden, or that has used its own resources to finance the business, but sells the same. Making viable with this, the comparison between companies of the same sector, even when they operate in absolutely different countries and situations.

Their knowledge makes it possible to indicate what a company can do with the assets what you have available; In other words, it is how much cost effectiveness contributes every euro that has been invested in the company or society. As an example, an oil company that has a ROA of fifteen% means that each euro invested in the company to obtain new investments, will generate fifteen pennies since euro What benefit.

The target CFO of any company, is to improve the cost effectiveness of the same, fundamentally if there are investments made recently, reason why more obvious results are required. Actually, this is the essence the same of the Finance of a dealIn other words, it is the ability you have to generate a flow of income sufficient to achieve the objectives that have been set.

The cost effectiveness what does he have assets represents the cost effectiveness financial that the company has, this means that the profit obtained in the company with the investment done. In other words, the total value based on the conventional activity.

In short, it is a measure that evaluates the efficiency of a company and gives us a broader picture of the benefit that the company can generate with the resources invested.

Interpretation

Based on the formula to get the ROA shown to you, we can deduce what a company should do to boost its ROA:

- Increase the sales margin, reducing manufacturing and production costs or increasing product prices.

- Increase the rotation of assets, increasing the number of sales in new markets or in the same ones through some commercial action that benefits the popularity and sales of the company.

As analysis, we have two different models to achieve a high return on assets: the first model are companies with a high profit margin such as luxury posts, brands such as Apple, Rolex, Bentley, and on the other hand we have the model of companies with margins little ones since to win in their products, but with a enormous rotation of assets, cases like: McDonald's, Burger King, Pizza Hut.

Difference between ROE and ROA

You must clearly establish the ROA with the ROE since, although in some cases they are generally equal numbers, in many other cases they are not.

If the company does not have financial debt, the ROA and the ROE they will match. But in the event that the company has debts of any kind, then the ROE will always be higher than ROAThis is due to the leverage that occurs in debt, since not so many fixed assets are required to carry out business activities normally.

The ROE measure the capacity that the company in question has, in order to remunerate economically for shareholders that are associated in this, so if it involves aspects of financial and tax debt.

The ROA Instead, it is used to accurately measure the efficiency of the company's total assets, regardless of how it was financed and the tax laws of the country where the company's activities take place.