What does PER stand for and what is it used for?

When we talk about PER, we refer to a definition that is widely used in the economy sector, especially in relation to companies, since the PER is the price-earnings ratio; that tells us what is paid in the market for each monetary unit from which a profit is obtained.

What is this result for?

This result It is only representative and shows us the valuation in the stock market and how the company could make a profit or generate the maximum viable. This type of data is one of the most required and valuable for companies and its calculation is very simple.

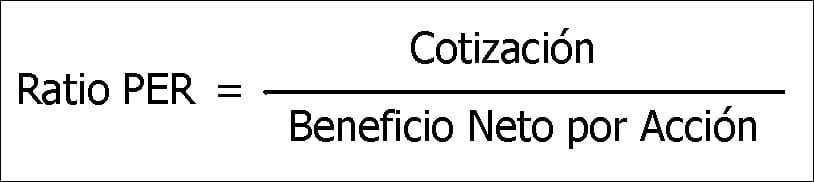

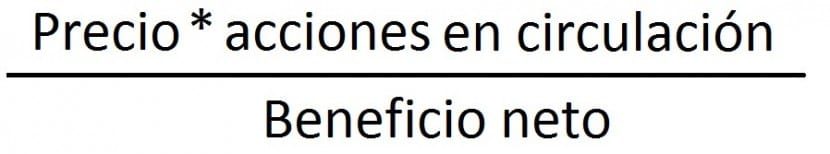

How the PER value is calculated

PER is equal to the market value of a specific company, that is, the number of shares multiplied by the price of each of the company's shares divided by the company's net profits. So, the price of each of the shares for the benefits of each share.

How to read the PER result

When we take the value of the PER and this value is higher than the current market value, it indicates that the company has very good growth prospects and expectations are very high.

High values in PER results

In the case of high values, the shares of the company show totally positive results and the prices of the shares will rise at all times.

This is regardless of whether the company has yet to report earnings. Now, If the stock price remains stable, the PER will decrease. You must be very aware of the additions and removals of the company's PER; since at any moment you can have negative expectations about the company and you must be ready for this.

In case the PER is low, the main problem is a type of slow growth in the company or perhaps almost zero. If the shares do not rise, the consequence will be a low expectation for the company or very slow growth for the future.

Is the high PER of my company's stock expensive?

No, your company's high PER does not indicate that your company's stock is expensive or that you can sell it at a higher price or that you need to quickly start trading the company's stock. This just tells us that everyone the company's shares will continue to improve and that are higher than average growth expectations.

When to trade my company's stock

You can only think about marketing, when the PER is high but the company's growth expectations are not higher in the future. Here, if you should think about marketing.

On the other hand, a low PER in a company does not necessarily mean that stocks are cheap and they have to be cheaper in the market. This company may have a low PER but positive expectations. In spite of everything, when the company does not give growth expectations and is not receiving any type of profit, it will have to be sold as soon as possible to avoid future losses.

When there are growth expectations in the company, but it is not having any type of quotation, it is necessary to wait a bit and compare said company with other companies in the sector close to ours, to be able to see what its true growth probabilities are. is it so. .

It can also be seen at the country level, since many companies decide to change their location or points of sale instead of closing the company or trading the shares at a much lower price.

What makes it possible for you to know the PER and what advantages does it offer you

Regarding the benefits or advantages that this type of calculations provides, it is that it gives us the opportunity to perform a comparison between companies in the sector that are listed on the Stock Market and ours. It also enables us to compare our company with those that exist nationally and internationally and make an internal calculation of the company to check if it can be sanitized or not.

What disadvantages does Peru have and what problems can it cause?

As to drawbacks of PEROne of the most notorious is that two different magnitudes can be related at the same time, since the earnings per share obtained can be seen through the financial statements of the company that have been had in the past with the price of the current shares; which can give us the data of future expectations with the rhythm of sales that has been made so far.

If you want to fix this problem so that you can receive more real data, the key is to use an estimated earnings per shareIn spite of everything, this method cannot be used in companies that have not received benefits.

To get even more accurate data, what you need to consider is the Assess cash flow or the well-known "internal cash flow" and include it in your calculations.

Other alternatives to calculate PER

One of the first alternatives to do this is by placing income or profits in the company for a full year. The total value of the year is used as the main value to be able to calculate the BPS

A good example is this:

Suppose we are trying to calculate earnings per share for company X, for example Facebook. What we have that you take as a basis is the net profit that the company has, for example 17 billion (possibly more).

You must be very careful not to take the quarterly net but the annual network so that it can give you a real result. If you use the quarterly calculation, the result will be three times less than what you require and the results will not be the most appropriate.

The quarterly earnings of the company, only serve to understand how the company is doing every three months.

Later, you should know how many shares of the company are outstanding. Suppose that in our example, the company has 8,000 shares.

The last step is to divide your net income by the shares you have outstanding. 17 billion / 8,000.

I have to obtain the PER from my company, how does it work?

All companies must know the PER it generates, to be able to check if it is a company that will be profitable and when it will be.

If we know how the PER works and we know how to correctly interpret the data, this will give us the perfect vision to understand which stocks you should select to make investments with them.

Another example for you to understand and interpret correctly is:

Let's imagine that we have a business where we sell PCs, each PC costs us around 100,000 euros. In each sale, we obtain a profit from each of the PC's 10,000 euros. Over 10 years we will have already recovered all the investment we made at the beginning. This means that our business has a PER of 10 = 10 years.

If we want to take this to the world of the Stock Market, the 10 PER that we have obtained means that until 10 years later the company will have losses of some kind or at least it will not have 100% of profits.

We must know that while we have a lower PER, the return on investment will be much better.

What do I do if my PER is always negative?

There are times when companies always have a negative PER. This means that your company is losing money and the investment will not pay off. The PER is something that changes but when it has given us the same PER too many times or changes for the worse, it is clear that something is not right.

Which we must do in these cases is to see where the company is having losses is to recognize what the problem is and begin to take serious precautions to prevent our actions from falling completely.

How can I find out the data of other companies similar to mine?

If you want to know a little more closely the data of other companies similar to yours to see how they are handled, there is a page called invesgama.com where you will be able to know all the data of the companies that are on the IBEX.

To participate in the companies that make up the IBEX, you must know that discipline is essential, since your company will be reviewed every three months through sales reviews and PER reviews every year.

Having all the constant information of your company will help you see when there are leaks or losses in time to boost the situation and ensure that our shares do not go down.