The accounting of a company is based on the principle of Double match, which starts from the premise that any economic action has its origin in another action of the same value, but of the opposite nature. This system is used to record all the accounting operations of a company.

What characterizes the double entry method?

This accounting system is governed by three fundamental guidelines:

- No exist post without counterpart, or what is the same: there is no debtor without a creditor.

- One or more debit accounts correspond to one or more creditor accounts for the same amount.

- And, related to the previous pattern, sums of quantities entered in the debit must be the same as those entered in the credit. At any time in the accounting cycle.

These guidelines are summarized in the following equation: total assets equals the sum of total liabilities and equity (A = P + PN).

In practice, when is it applied in the accounting of a company?

The double entry principle applies to all accounting operations. And if we take into account that companies have the obligation to record all the accounting operations they carry out -first in the Daily and then transferred to ledger-, it is obvious that the double entry system is constantly used in accounting.

In addition, it is necessary to pay attention that in each accounting operation two or more accounts are involved and that in all the entries there is at least one debtor and one creditor account. Thus, in the Have to (located to the left of the entry) we will place increases in assets and expenses, as well as decreases in liabilities and equity. Instead, in the To have (to the right of the entry) we will place the decreases in assets, increases in liabilities and equity and income.

The double entry system is one of the concepts that you will learn as you study. FP Management and Finance. This cycle of Higher Degree will allow you to work in the accounting department of a company taking the accounting of the different areas.

Double Entry System Case Study

The following examples are very simple, but they serve to illustrate how the double entry system is applied in all accounting transactions, otherwise the transaction record would be incorrect:

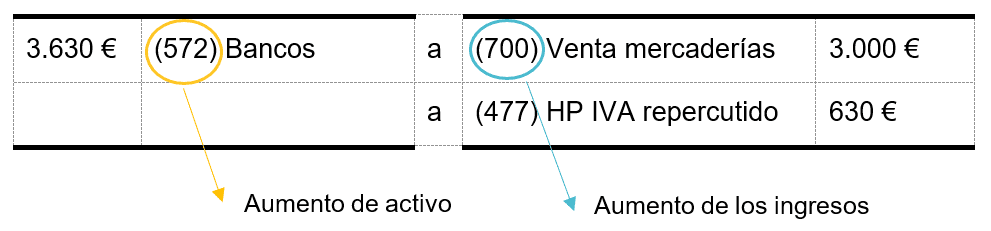

Company A charges 3,000 euros (plus 21% VAT) for the sale of goods through bank transfer.

The entry to be made is:

In other words, in Debt we will place the asset accounts, in this circumstance the (572) Banks and, in Credit, the income: (700) Sale of Merchandise. As can be seen, the sum of the debit and credit amounts coincides (3,630 euros), which is why the double entry system is achieved.

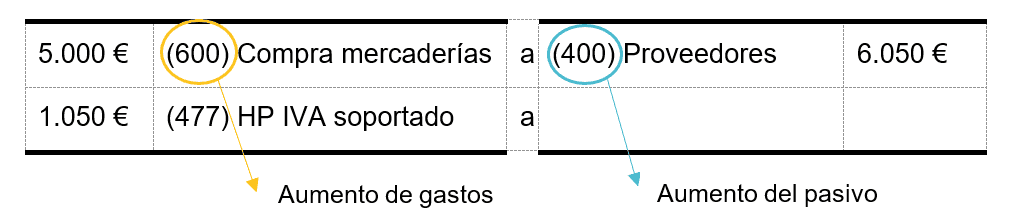

Instead, company A buys goods from a supplier for 5,000 euros (+ VAT) and will pay for them in two months.

The entry to be made would be:

On this occasion, in Debt we will place the expenses and, in Credit, the increase in liabilities -the pending payment to suppliers, the account (400) Suppliers-. As in the previous example, the sum of the debit and the credit matches, giving the double-entry method.

Is it feasible to study accounting at a distance?

Yes, on the internet you will find many videos and tutorials, but if you need to follow an agenda and get one Title official Authorized by the Ministry of Education and FP, the Higher Degree in Management and Finance is an alternative. On ILERNA online you can study at your own pace, when, how and where you want and with the support of teachers, didactic material and video classes weekly. Likewise, you will be able to take the final exams for each subject in the capital of the Spanish province closest to you.