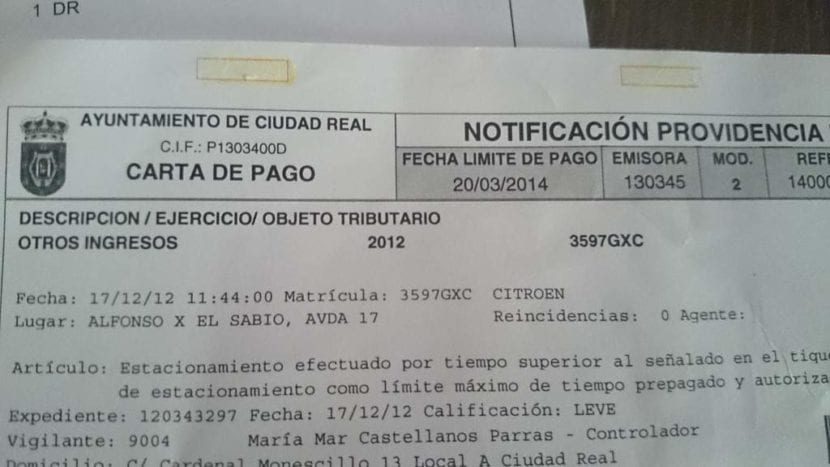

What is a boost? Refers to execution process or means of execution when there are a series of procedures that are followed and that condemn the payment of a monetary amount.

Whether it is taxes, goods or services, this happens when the the debtor has not made payments in a timely manner as stipulated bilaterally. It is when payments are not paid voluntarily by the debtor when coercion is applied as a process in which the debt with the debtor's equity is collected and settled.

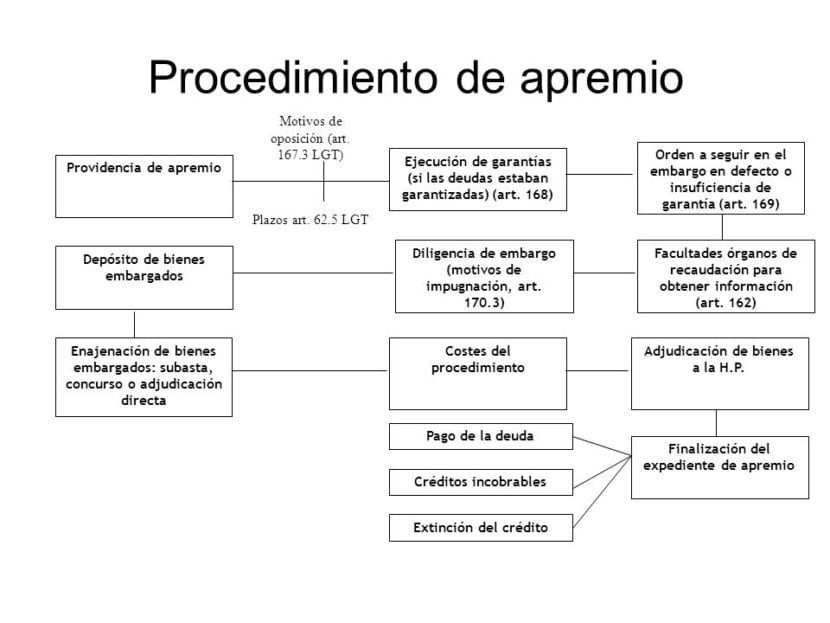

What is the execution process?

Regularly the The taxpayer must pay his tax debts or taxes in a timely manner., thus stipulated.

This means that the debtor will pay his debts within a voluntary payment period as also marked by the direct or indirect taxes.

In the absence of payment within the period of voluntary payments, a debit and the growth of a interest rate for lack of to pay and finally arrives to the urgency.

It is known as the collection process or procedure whose execution is forced. With the support of the executive title that has been issued by this public entity and thus proceed to give effect to its public law credit through the individual execution of the debtor or debtors' assets.

This act legitimizes the management proceed against the assets of the debtor in question.

There are 20% tax surcharge on debtAt the same time as this, the order of urgency will generate «default interest”.

As a result of the accumulated delay in the payments of pay off the debt. In the event that the debt is settled before the communication of the executive order, the The 20% tax surcharge on debt is reduced to 10%, without generating interest for late payment.

Times in emergency providence

The execution process it begins when the notification is made known to the taxpayer. It is in the execution order where this outstanding debt is identified.

Inside of executive period charges are settled and the obligee is requested to make the payment in question.

The executive period begins the day after the deadline for the voluntary pay period.

Once the executive period begins, management can start with the execution processHowever, before you start you should notify an administrative act known as "the execution order".

Same that can be considered as sufficient title to start the process. The order of urgency has the same weight and executive force as a «judicial sentenceTherefore, with this it is feasible to proceed against the assets of the taxpayer in question.

Characteristics of the Emergency Providence

According to the LGT, characteristics of the execution process are as follows:

- The execution process is solely and exclusively administrative.. Only one part of tax management is the task of solving incidents within the execution process, as well as understanding the particular case.

- On its concurrence in this regard with other enforcement proceedings. The enforcement process cannot be combined with legal proceedings or any other process that involves persecution.

- Within the concurrences with unique execution procedures. In these cases, the oldest seizure will be the one that is given preference, within this particular case, the importance of the case will be taken from the date of the seizure process.

- On the concurrence of universal enforcement or bankruptcy proceedings. Yes, and only if the execution order was issued prior to the insolvency declaration date.

- The execution process has initiation and promotion of the trade in all and in any of its procedures.

- The suspension of the execution process it can only be carried out under the assumptions provided for in the tax regulations.

- In any of the cases provided for in the tax regulations.

- In the event that the debtor pays the debt in full.

- In the event that there is a material error on the part of the debtor, or an error in the determination of the debt.

- Due to third parties. This happens when a third party seeks to lift the seizure because it is understood that it belongs to him in domain or that, in preference to the Public Treasury, the third party in question has the right to be reimbursed from his credit.

Effects of the emergency provision

Once the execution process begins, the effects that are contemplated are:

- The tax management in question can and can exercise the executive powers that exist throughout the execution process. This in order to collect the outstanding debt, made through seizures and execution of guarantees. Regularly this type of executive actions cannot be carried out immediately after notifying the debtor, a period of time that may be referred to in any regulation must elapse.

- About the entry period. After the notification of the «emergency provision”, You will have the possibility to pay or settle the debt. As expected the taxpayer can earn income at any time during the executive period, as long as this happens before the notification of the execution order. Although the payment can be made, there are also differences for making the payments at different times, this difference lies in the surcharges of the executive period and the interest for the delay, which the debtor must pay in full.

What are the reasons for opposition to the executive order?

It is stipulated that there is no reason for opposition outside of the following listed and thus, it will not be taken as reason for opposition to the order of urgency for any other reason other than the following:

- The debt is settled, it is extinguished in its entirety or there is a prescription of the right to demand the payment of the same.

- Opposition to the execution order will be feasible in the event that there is a request for postponement, compensation or fractioning within the voluntary payment period or other causes for the suspension to occur.

- Opposition to the executive order will be feasible in the event of failure to notify the debt settlement.

- Opposition to the execution order will be feasible in the event that the settlement is annulled.

- The opposition to the executive order will be feasible in case of omission or error in the content that makes up the executive order, the same error or omission that is an impediment to identify the debtor or within the parameters to understand the debt.

About the seizure of property and rights

The seizure shall only cover the part proportional to the value of the assets and rights that covers the value of the debt that was not paid, the interest for late payment thereof, the surcharges of the executive period and any cost for the execution process.

By coincidence Assets or rights whose amount exceeds the value of the aforementioned amounts should not be seized.

Within the seizure order. In this order, certain criteria are established that determine the order that is followed throughout the embargo:

- The agreement with the taxpayer in question. Whenever the taxpayer requests it, the order of the seizure procedure may be altered, this without neglecting that the seized assets guarantee the value and the collection, with the same efficiency and as soon as possible, this without causing harm to third parties.

- If there is no agreement, the goods will be seized. In this regard, those assets that are simpler to market and less expensive for the debtor will be taken into account.

- During the validity of the embargo, the following order will be carried out:

- Cash or capital deposited in credit institutions, as long as they belong to the debtor.

- The rights and securities that can be realized in the short term, as long as it is less than 6 months.

- The debtor's wages, salaries and pensions.

- The debtor's real estate.

- The interests, income and fruits of the debtor.

- The industrial and commercial establishments of the debtor.

- Debtor's antiques, precious metals, goldsmiths, fine stones and jewelery.

- Movable and personal property of the debtor.

- The rights and securities that can be realized in the long term, this term being greater than six months.

Known assets and rights will be seized in the order mentioned previously., despite everything, there is two exceptions or special rules mentioned below:

- Finally, there are those assets that require the necessary interference in the taxpayer's domicile, this can be furniture, jewelry, etc. As long as these assets are inside the home.

- The types of property "unreachable" by law will not be seized. An example of this is the pension fund or a tool with which the trade is exercised, at the same time paying attention to the unattainable part of the salary or salary.