One of the questions that more people have is How long does it take to file a tax return for the balance in my income statement? Even though the farm promises that the money will be returned in 5 days, many people wait longer to enjoy their money.

Today we are going to clarify because this happens

Every year, a large part of the people who file the income tax return have positive balance. As is normal, many people expected that said money would be returned to their accounts in a period of approximately 5 business days, despite everything many people do not have the money in their accounts within that period.

This begins to arouse anger among people, who, far from taking things easy and seeing their case separately, begin to get angry.

Credit balance for taxpayers in 5 days

Even though hacienda has said over and over again that the credit limit will be ready for taxpayers within 5 days, the reality is that this is only thinking of people who pay taxes on a salary basis. In other words, this idea of the 5 days was created to encourage people who regularly do not file income tax returns to do so.

Automatic return

Cases of automatic return, which are made to people who promptly file their annual return, exclusively demand the balances in favor related to external taxes and not the taxes levied on the activities of natural persons, as well as cases of alienation or provision of services. Neither do they enter into the enjoyment of goods.

The relevance of the annual declaration for workers

In spite of everything, there are fixed deadlines by law for the property give you your money back with credit balance. It is essential, whether you report income annually or not, that you are clear about these deadlines.

The legislation defines that, if everything is in order with our income statement and no type of irregularity is found, the money can be saved in the bank account, in term not exceeding 40 days from the date the taxpayer requested the balance in favor of the taxpayer.

Hacienda can modify this date

Yes, the Treasury can modify this date, if it considers that it must request the taxpayer proof of the origin of said balance in favor. In other words, you can request proof from the taxpayer of the truthfulness of your statement and this in turn has a maximum term of 20 days to deliver all the documentation. Among the things that the estate may request are: taxpayer data, reports of the data offered in the income statement or any other additional information that the estate deems necessary to verify the origin of said money. Even when the taxpayer delivers all the documents, the taxpayer can choose not to give the money to the taxpayer, since the data that the person is showing does not see it as real.

If everything is correct and the person delivers all the data correctly, the Treasury has a few days to deliver the money after the documents are delivered.

In the event that the taxpayer delivers all the documents but the Treasury still needs more to verify the origin of the money, a new within 10 days to deliver the new documents that are requested. If after this period, the Treasury still cannot verify its origin, it will automatically be denied.

Other cases that may delay your return

If you have many errors

In the event that the taxpayer presents an income statement in which it is clearly seen that he has errors in the data it contains, the Treasury has the power to request the taxpayer to clarify in writing and within a period of 10 days, all the data. found on said paper and deliver them.

These errors can be of any type, from a problem with the bank account for the return (In other words, the numbers do not match what you already have doing) to the personal data you already have about that person.

In the event that the problem is in the numbers with the amounts to be returned, the Treasury will not ask the taxpayer for clarification and will return the actual amount marked by its system, without the need to call the taxpayer to make a supplementary declaration.

Related post:

How to do the income statement?

As you see hacienda you can extend the date of your payments well beyond 5 days and even 40 days by law, as long as you can prove that the income statement filed by the taxpayer is not correct.

In case after submitting your statement of incomeAfter two weeks and the Treasury has not contacted you, it is likely that there is no problem with your income statement and that it only remains to wait for the money to be placed in your account automatically. Remember that, if no one contacts you to request more documents, the period by law is 40 business days to be able to enjoy your money.

What happens when you reject my return but don't tell me because

This, even though it is not normal, has happened, leaving people who were waiting for their money without knowing where they can claim to fix this problem. Actually, many people are refused returns without informing and they find out when they initiate a complaint procedure.

In case we have this problem, we have the opportunity to claim, since by law, the Treasury must notify us that our return was rejected and why. In this circumstance, you must open a statement against finances to clarify why your return was declined and what documents you need to verify the data. At the same time giving you a period of 20 business days to deliver the documents.

In the event that hacienda does not enter its money within the current year, the payment must be made in the same way, despite all hacienda, a payment of 3.75% in interest must be added to the amount already stipulated.

How to claim a refund of rent money

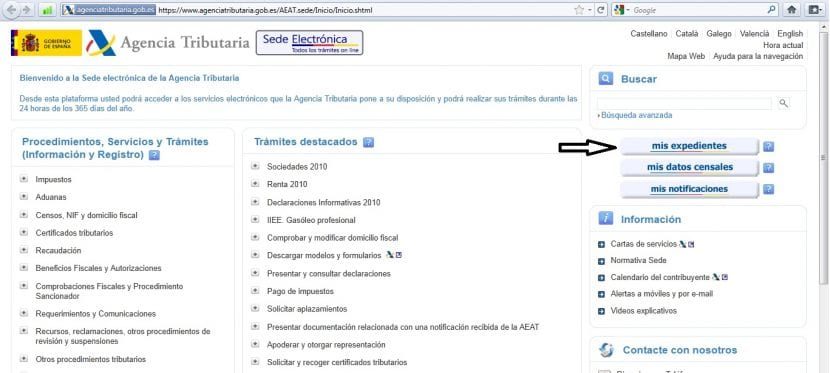

It is not feasible to make a claim about the farm as such, since the platform does not allow this step, despite everything we can review our status on the farm and see that everything is still correct, because as we have spoken in the part of up, sometimes Treasury rejects the return but it does not notify the taxpayer.

For it is important that you know where your claim is, we are going to tell you the messages that may come out.

Pending declaration

This option comes out when our document is already on the farm, despite everything, they have not yet reviewed our request.

Declaration with amount in process. Check the quantity.

This arises when errors have been detected in our income statement. Regularly, in these cases, the declaration must be completely redone or if we are still within the term, contact the Treasury to verify what the errors are.

Registered declaration and data verification.

This indicates that the farm is reviewing the income statement.

Income statement processed

In this circumstance, it tells us that the declaration has already been processed and that the Treasury agrees with the data and the requested return. In this circumstance, we can only wait for the farm to tell us on which day our money will be deposited into the account.

Your return has been issued

Your money has already been issued. If within 10 days you have not received the amount you expected, you should go to your management with the information of your tax address; In spite of everything, in general it is not necessary since the farm has issued the payment.

What if my payment never arrived?

The best option is to go to our nearest tax office, where those responsible for the place can tell us what the status of our account is or why we did not receive the payment and how we should proceed.

If the farm ignores you or gives you a lot of time, you can go as last resort to AEAT and you have to make a claim. To be able to do it through this platform, you have to have a digital signature, otherwise you will not be able to do it.

Although this will not expedite the payment, since there is nothing to expedite it, we will receive a message from us that will tell us what is really happening with our procedure and whether or not we will receive said payment, even when waiting, in the end, it is the same for everyone.

Related post:

How many taxes do we Spaniards pay?