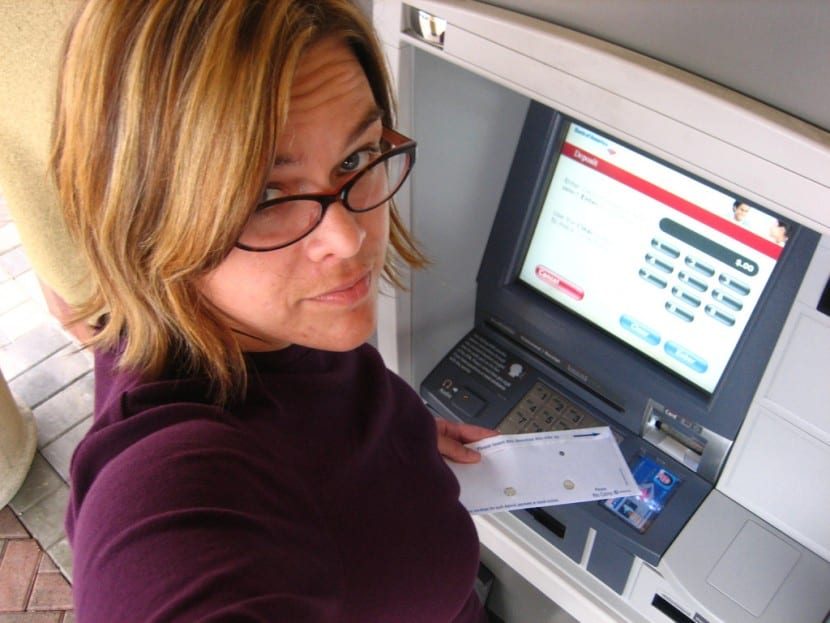

Starting this new year, it will be necessary to think more than twice before carrying out a cash withdrawal operation from ATMs installed in banks. The days when these movements were formalized without taking over any payments are gone. The new fees that banks apply to withdraw money from ATMs have been definitively installed in the banking sector.

All of them after the Council of Ministers approved a law to prevent banks from charging their customers a double commission at ATMs. This measure, which has already come into effect, has a transition period until January for the entities to decide how they are going to administer the commissions and if in conclusion they are going to pass them on to the client or not. Is what has happened now, and that it will be necessary to check how it affects bank users in this country.

Before generating these movements, it will be necessary to verify with which entity you are and how much they will charge you for providing you with liquidity. To help you know how much you are going to pay for this concept, it will be very useful if you carry a list in your wallet with all the banks and the rates that have come to light. This is so because there will not be uniform commissions, quite the opposite, each bank will have a different scale from another, equivalent, but not always the same. As a result, It will always be more profitable to do better the operation in some banks than in others.

Either way, you will always have a useful self-defense mechanism on hand if you disagree with the operation. And that is They should inform you in advance of the cost of the same, so that you can approve the operation, or, failing that, cancel it and try to repeat the procedure in another entity with cheaper rates. This information will appear clearly on the ATM screen, in all and without exception, while you are immersed in the procedure.

Will vary by bank

Regarding the new commissions, The movements within the same entity where you are a client will prevail, commissions eliminated. Not surprisingly, to avoid unnecessary expenses, you should pay attention to the location of the ATMs that are owned by your bank. Mainly when you go on a trip, go on vacation or basically move to another city on weekends.

The new rates that have already come into effect will be charged each time you go to withdraw any amount from these devices. Each bank will charge you based on who owns the card.. With very obvious differences between one and the other. Not in vain, if you use it correctly you can save many euros every year, without effort on your part. The only requirement that they will demand of you is that your information on these rates be as extensive as possible.

As on the other hand it is logical to think, The most profitable operation will undoubtedly be to develop them in the ATMs of the bank where you are a client, since they will not charge you anything for this concept, far from it. Whatever amount you withdraw: 20, 50… 300 euros.

From here will come the problems for your interests, since it will be time to make a number in the calculator, to check which entities will charge you less. And where, from the ATM, it will inform you of the commission that the bank that owns the dispenser will charge you to the card issuing entity, but that your bank may charge a different amount if it assumes parts of the commission.

How much will they charge you?

The differences will be very sensitive, from an entry of only 0.65 euros, up to 2 euros, which is the maximum that can be charged for each operation. However, it will be highly recommended to take advantage of the synergies offered by some financial organizations, and that you can take advantage of from now on. These are some of them, even though they may be temporary.

- popular Bank: you will benefit from the lower prices that they present in their operations (0.65 euros), in other entities, with which your opportunities to contain expenses for this concept increase considerably: Caja Laboral, Caja Rural and Cajamar.

- Direct ing: If today you are a client of this entity, you will also benefit, since the exemption of these payments will also be eliminated in the operations carried out through the March Group branches.

- Bankinter: your customers will be among the most favored of this new situation after the application of the new rates. This is because you will be able to withdraw debit money for free at the ATMs of other entities: Grupo Caja Rural, Caja Laboral, Cajamar and Deutsche Bank.

There are other entities, on the contrary, that keep the above strategies in force under zero commissions, but until further notice, which may be forthcoming. In reality, it is not ruled out that they can change it in a short time. Among them, Triodos Bank stands out, which continues in the same line of business as up to now. And on the other hand, Evo Banco, which does not charge any commission on the main devices, as long as the operations exceed 120 euros.

One of the problems that will arise from the implementation of this measure will be the one that comes from clients located in small towns. Where, surely, there will not be a wide offer to take advantage of, even if it is the case that you do not have an ATM from your bank. While in large urban centers this problem will disappear completely, as the number of terminals located along its streets increases.

Eight tricks to save money in these operations

From now on there will be more responsible in the selection procedure of the ATM to withdraw our money, whatever its amount. There is no other remedy. It may cost you a little more, even that you have to walk a few more meters to get to the most correct ATM so as not to shoot the expenses of our operations. But it will really be worth it, as you will see after a few months.

But at the same time, it will be necessary to import some guidelines for action, even varying them in terms of what you have been doing so far. However, your checking account balance will thank you, especially if you do these banking operations on a regular basis, since the savings can be more forceful. Even with more aggressive strategies, which will inevitably lead you to change banks, and opt for those that offer more competitive rates for maintaining your cards.

- First key: always use your own bank's ATMs. It will be the only way that you do not pay any extra euro every time you go to use any of its terminals. To facilitate the measurement, you must first inform yourself which are the branches that they have distributed throughout the Spanish geography. At least in the cities where you move the most.

- Second key: go to the one with the lowest rates. Given the impossibility of finding a branch of your own bank, the next step will be to opt for ATMs with less expansive rates, which there are, since the differences can present differences of up to 100%.

- Third key: you can always reject the operation.. It is possible that you do not know how banks apply these fees to you, and you may even be surprised by the result of them. Avoid worrying, you can reject it at the precise moment when you are notified of this incident through the ATM screen. And from this dynamic, you can lean towards those of other banks, if that is your wish.

- Fourth key: take advantage of banks that have not updated the measure. Especially at the beginning, some financial entities have been maintaining the same margins as until the arrival of the application of these new commissions. You can use it as you almost always have, and as long as they do not change their business strategy with their main clients.

- Fifth key: you use other more beneficial alternatives. It may be very difficult for you to carry out these behavioral guidelines, and to avoid higher expenses in your account, it will be more advisable that you provide yourself with liquidity through other channels when withdrawing cash, such as directly. in bank branches, as your parents did until not many years ago.

- Sixth key: if you carry out the operation many times you must stop the expenses. It is to a certain extent normal and understandable that sometimes you pay the highest commissions of this new scale, if the movements are punctual and exceptional. But if you consider that your visit to ATMs is more common, you should adopt a new strategy if you do not want to see how every month you lose a part of your bank balance at these rates that have recently come into effect.

- Seventh key: withdraw larger amounts. A little trick to get out unscathed from these bank disbursements necessarily involves formalizing higher amounts, greater than 100 euros, and in one go. Some financial organizations, even if very few today, allow you to select this unique strategy to contain expenses.

- Eighth key: do not affect the overdrafts of your account. With respect to overdrafts, it is a commission that is applied to the highest balance in red numbers that you have throughout the settlement period. And that you can achieve maximum margins of up to 10%, if you find yourself caught in this nasty situation.