When you have to fill in any of the models of the Tax Agency (of the Treasury), surely the fear of putting something that you should not, or forgetting to put it, can. And it is that, for many, the Treasury imposes, especially the sanctions that nail you for ignorance or for not being attentive to what to put (and how to put it). For this reason, one of the lesser known models, and despite everything that can bring you down the street of bitterness, is the 390. Now, how do you fill in the 390 model so that everything is correct and you don't have to worry? ?

That is why we have thought that it is best to help you understand what the 390 model is, what it is for and especially how to fill form 390 point to point for it is important that you know what you should put (or what not) in each of the sections that it has. Then you will no longer have doubts.

What is Model 390?

The first thing you should know precisely is what the 390 model is. It is a Informative declaration of annual summary of the operations associated with the VAT settlement. From this, we can explain several things:

1. That you should not pay anything.

2. That it is related to VAT (and therefore, to model 303).

Why should you make a document with information that you already passed in form 303? Well, because it is supposed to be an extended model. At the same time, it is It is mandatory to present it and it must be balanced in terms of the data that has been presented in the 303 form (mainly because if not, it will not let you present it).

Anyone who is a professional or entrepreneur and whose activity is subject to VAT must present this form 390, and it must always be done in January (the deadline is from January 1 to January 30). In that period you should pay attention to all the activity of the previous year.

What is the 390 model for?

As we have told you before, model 390 is in fact a summary that is made to the Treasury on what VAT has been paid during the year. This is why it is so important to have the 303 models you made that year on hand, since it will make things easier for you, and a lot, especially to square everything.

For the Treasury, this model is essential because It serves as a summary of everything you have declared. In other words, instead of having to search for all the 303 models that you present (which are 4 in total), what it does is have it all included in this document.

It may seem like a duplication of data to us, and it really is, but since they handle data from millions of people, having "summaries" always helps them go faster. At the same time, it also serves as a "warning" in case you do not find the VAT done in a quarter (because you forgot it), and there you can be penalized.

How to complete form 390 point to point

Now that you know the 390 a little better, it's time for you to do it. The only "bad" thing about this document is actually squaring it up. And sometimes the pennies can give you bad tricks and if you don't take into account the different values of the 303 models, you can spend hours trying to make sure that everything is correct.

But how do you fill out form 390? We explain it to you.

The first thing you should do is Go to the page of the Tax Agency (or Treasury, whatever you want to call it). Next, go to the informative declarations, or use the search engine that they have and put the model 390 or only 390.

Click on Form 390 and it will take you to the Annual Summary page. If you submit it online, in other words, electronically, you must submit the 20XX Presentation exercise.

As you will see, there are more procedures to do it, but we suggest you do it online because it is faster to do.

First sheet of model 390

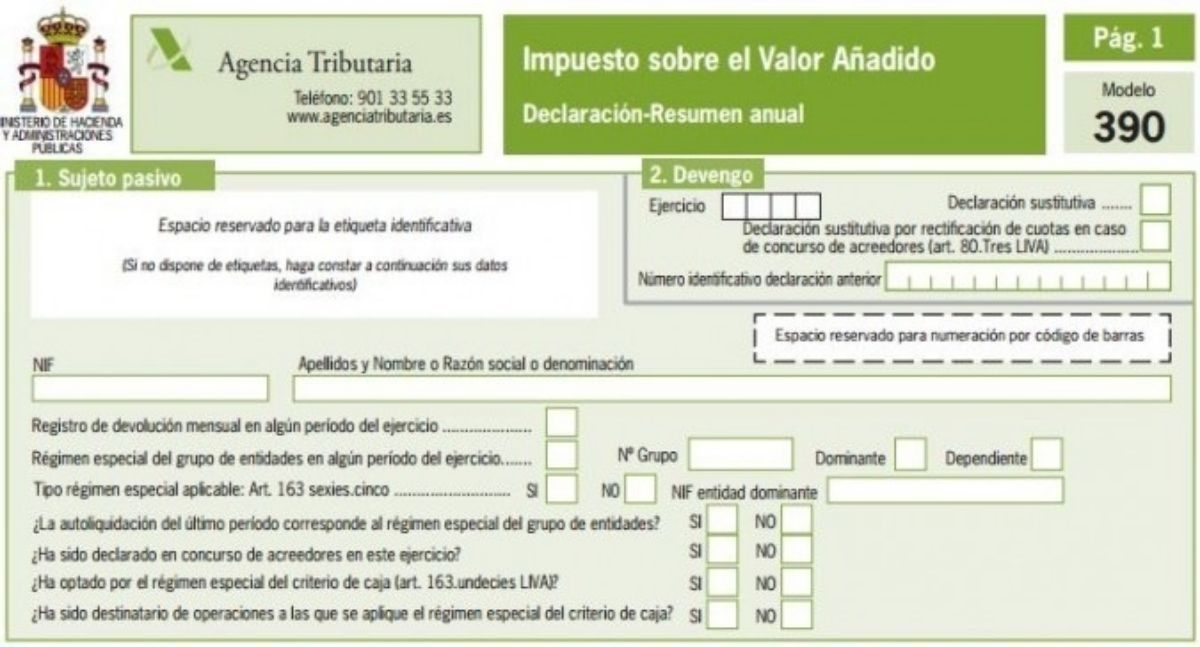

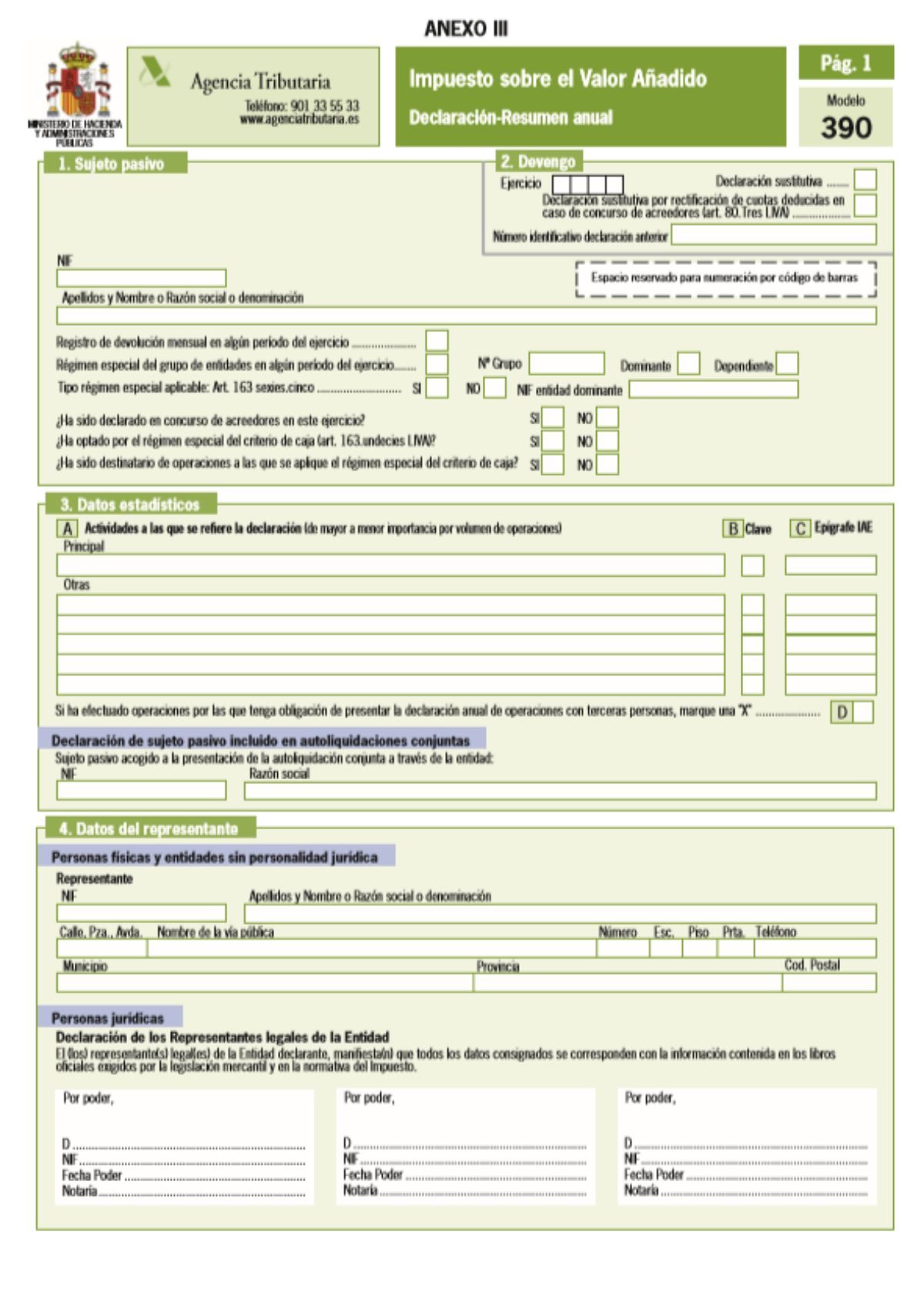

On the first page of the presentation, what you will have is your personal data, in other words, NIF, name and surname. Nothing else.

Once you complete it, you can give New Declaration and you are ready to start filling in the data.

Another alternative is to load the data of a declaration that you have already started, but since we are talking about something "new", you should not do anything.

How to fill in form 390: next page

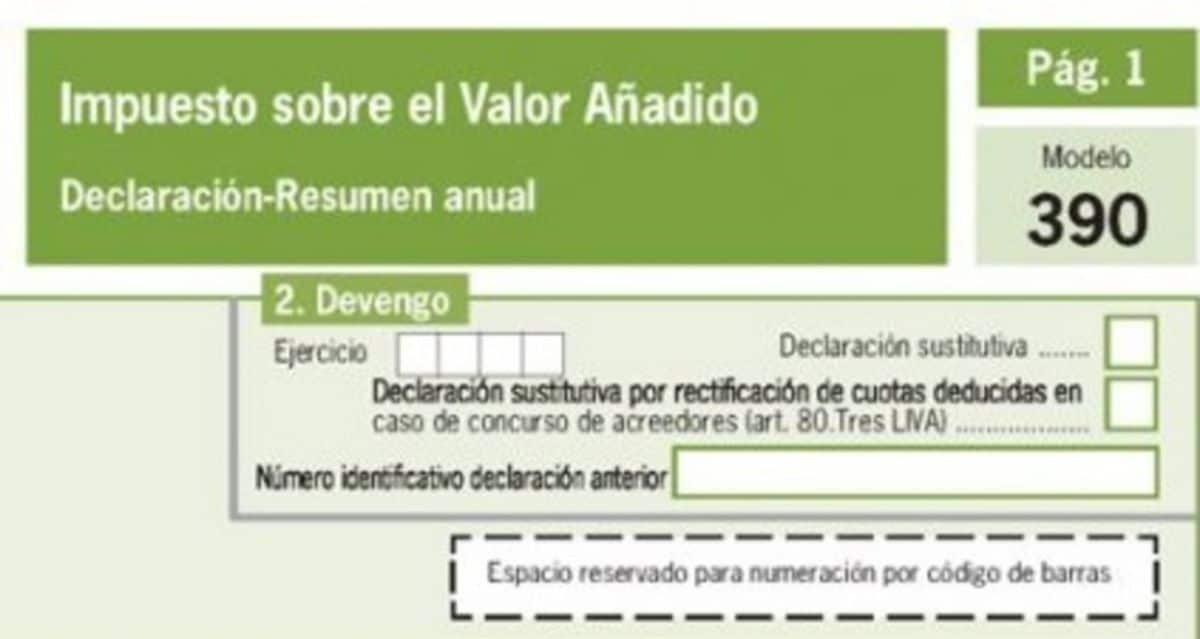

Next, you will get a first screen where you must complete data such as:

The year to which the statement refers, and if you are in a special situation (not regularly). So if you have neither cash nor bankruptcy criteria, put everything that is not.

Representative details

On the next page, the statistical data, you will need to add your activity. This is completed in part B, where it says Key. You have a pencil and if you give it a list of activities will appear. Locate the IAE code that has your main activity and that's it.

The next information you are going to request is that of the representative, but if you do not have anyone and you represent yourself, you should not fill in anything here.

Operations carried out under the general regime

The fifth page of form 390 refers, now, to the most important data of the declaration. And what should you put on? First, have all 303 models on hand (VAT) of the year. Focusing on accrued VAT, you must tax your annual income, in other words, what you have earned with your invoices. Then, in Accrued Quota it will be the VAT that you have paid for those invoices that you have made.

Now, that is normal, but you may also have to fill in the chapter on intra-community acquisitions if there are amounts of purchases that you have made in the European Union (if there are none, leave it blank).

Operations carried out under the general regime (continued)

This page is the second that will appear and, in this case, it will refer to the deductible VAT, in other words, the one you have borne in your expenses. What should you do? Well, as before, put in current Internal Operations, on a tax base, the expenses without VAT; and in deductible installment, the input VAT.

Here you should be more careful and distinguish between Acquisitions of Goods and Acquisitions of Services.

How to fill in form 390: results

Once you complete the above, you will turn to page 10. And now you need to check two very important boxes:

- Box 84: which is the result that must be equal to all the 303 that you have presented.

- Box 85: is the result of box 84 minus the amount of form 303 for the first quarter.

Finally, you have box 86 which, yes, is the final result of the model. But beware, everything has to fit or it will fail you.

The last steps

There are some last steps which are:

- Box 95: you must put on screen what you have paid in each quarter of form 303. As it is quarterly, you must put it only in March, June, September and December.

- Boxes 97 and 98: Here you must have access to the amount of the 4th quarter of the VAT model 303 (if it has been returned or offset). If it was to pay, do not put anything.

- Box 662: enter the fees pending compensation.

- Box 99: complete the operations under the general regime, in other words, add the impossible bases for the whole year, but without adding VAT, or Equivalence Surcharge, or Personal Income Tax.

If everything fits, you can present the model without problem. And if there are errors, possibly the largest of them (the results of two boxes do not match) is by a difference of pennies.