The transfer is a banking operation that is most frequently performed by users who have a bank account at any institution. They facilitate and allow the sending of monetary amounts between two designated accounts with the simple fact of knowing the IBAN code. It is impossible for the user who orders the transfer to control the moment when his transfer will reach the beneficiary.

Bank transfers are operations in which a bank is requested to send a certain amount of cash to the account of a third person who may or may not be in the same bank. It is not feasible for the user to speed up the transfer procedure, but it is feasible for them to know important factors that will make it possible to decrease the time of the transaction by choosing the day, time, location and route by which they will decide to carry out the operation.

What types of transfers are there?

Transfers can be categorized under different criteria, all depending on your delivery time

Other more specific bank transfers are those that use the accounts of the entities in the Bank of Spain, which are known as Orders of Movement of Funds (OMF).

Although this type of banking or interbank operations are very common and generalized by the majority of users with bank accounts, it is possible that it can generate confusion since it is not entirely clear the day of execution of the same or the time in which it does. it will take time to reach the destination account.

We can find the following transfer classifications Taking into account geographical criteria, the means by which the transfer order is issued or the type that we request to transfer money from one account to another.

Geographical classification

This group is in charge of the country of destination of the funds according to the residence of the current account of destination. Within this classification you can find:

- Transfers national: The one who sends as the recipient who receives is in Spain.

- Foreign transfers: Those in which the beneficiary is in another country.

At the same time as this classification, there are also transfers between the same square which are the national transfers between the same locality and transfers to a different location: between two cities.

Transfers made personally from the branch office.

Classification of transfers according to the way they are ordered:

- Transfers by ATM machines.

- Transfers made by telephone or fax.

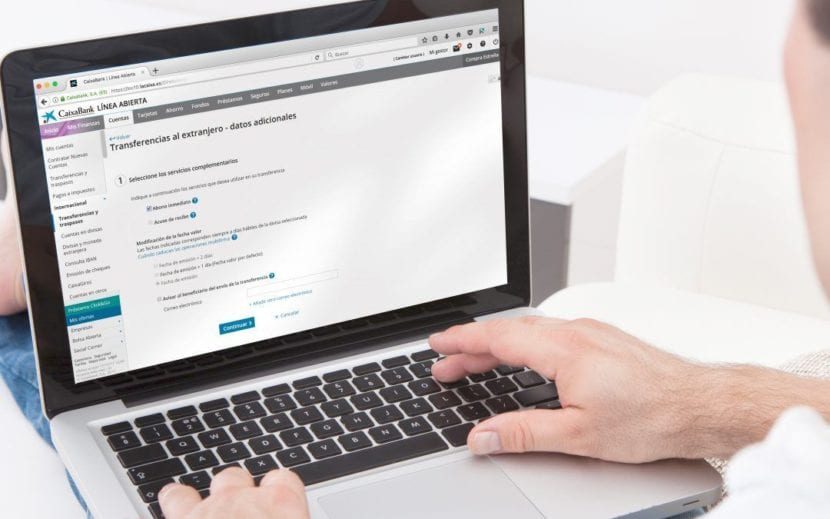

- Transfers by Internet.

Throughout the time it takes for the funds to be credited to the destination account:

- Transfers Ordinary: Between one and two business days, everything depends on current regulations.

- Urgent transfers: They are credited to the destination account the same day.

Urgent transfers are characterized by being OMF (funds movement orders).

Deadlines for bank transfers

The timing of the extension of the transfers varies greatly in its term since it goes from the same day the operation is made until days later.

In general and this from the entry into force of the Single Payment Zone in Euros known as SEPA, national transfers made in euros and international transfers that go to countries belonging to the European area, have maximum period of one business day.

Before, the maximum term for bank transfers was 3 business days for transfers outside of Spain and 2 business days for those originated and received in properly Spanish accounts.

The business days Well, they can be understood as those days of commercial opening in which the European payment system (Objective).

To know the business days, you must count the days of commercial opening in which the system is not closed OBJECTIVE you should pay attention: Every day except Saturdays and Sundays and holidays: New Years, Good Friday, Easter Monday, May 1 and December 25 and 26.

Taking into account those days, we can deduce very quickly and easily what many people already know: Friday is the least suitable day to carry out a banking operation of this type if you want it to be reflected quickly.

In any case, it can be said that there are exceptions, as would be the case of the instant ordinary transfers since they are all those operations that are carried out between two accounts of the same bank, it can be said that these operations are instantaneous since being a internal transfer it is just a simple accounting entry for the entity.

All entities have a time called "cut-off time" and if you make the transfer moments after that time, it will be considered received the next business day.

Given this, it is very important to pay attention to this time, since, if you make the transfer before or after that time, it will take 1 business day more or less.

After all this that has been mentioned, it is likely that it occurs to you if there is an opportunity to make a transfer to another bank but that it executes the order the same day or instantly and the only feasible option for that is the OMF transfer.

Instant transfers via Bank of Spain

Despite the fact that with the latest Payment Services Law, ordinary transfers are paid in a maximum of 24 business hours, it is very likely that you may have the need to make a urgent transfer from one account to another with the requirement that the monetary amount be paid on the same day.

Type transfers Order of funds movements They can also be called transfer via Bank of Spain, they have their main difference and advantage in that they are paid on the same date that the operation was carried out.

To issue this type of transfers, the entity must have an account with the bank of Spain since it is through it that they are carried out (in the same way, the bank of Spain is the one that gives the name to the operations).

They are fast but among their possible drawbacks I would highlight the difficulty to cancel them, in the same way the high cost of them, or that they are only possible to do during the working hours of the bank of Spain, therefore, it is advisable to consult and consult all the essential conditions to carry out these operations.

There are 4 main factors that are responsible for establishing the delay time of an operation: the day, the time, the route (electronic or in person) and the location. As of January 2012, the law dictates that mandatory electronic transfers must be made effective no later than the end of the business day following the order.

You should also investigate the time your bank has placed your "Cut the time" for your transfers by digital or telephone means since it refers to the moment from which your banking institution considers any order received on the next business day.

Generally, OCU cut-off hours for wire transfers:

- La Caixa 11.00 h Barcelona

- Evo Bank 2:00 p.m. A Coruña

- Unoe 3:00 pm Madrid

- OpenBank 4.30 pm Madrid

- ActiveBank 17: 00h Sabadell

- iBanesto 18:00 Madrid

- Bankinter 6.30pm Madrid

- ING Direct 7.30pm Madrid

- Banco Pastor 20.00 h A Coruña

These and other times are what you should pay attention to when making the transfer since in your local time it is possible that you still have time before the cut-off but in another region, the day has ended and you have a full day lost.

To make the transfers, the location from where we make the transfer and also to which we send the money can affect the operation hours since you must pay attention to local holidays, find out if it is a business day or not. This applies whether you have made an online transfer or if we have given you the order from an office.

In the end, the best thing you can do is avoid holidays and eve as well as request the transfer to the bank in the morning. And to round off the operation, it is also better to work with banks that do not charge transfer fees:

- EVO smart account. It does not charge a transfer fee and offers profitability. It enables you to withdraw free cash from any ATM in the world.

- Current account triodes. The leading banking in Europe gives your account five free transfers per month. From the sixth, the cost of each one will be 1 euro.

- Open payroll account. Santander's online banking does not charge commissions either.

- Banc Sabadell account expansion. By directing the payroll in Sabadell, the client is exempt from paying commissions for national transfers and in the European Union for a total amount of up to 50,000 euros.