What is fixed capital?

In the economic and business world, the term "capital" is used for everything important that helps to generate more goods and services, including personnel, machinery, places and others.

According to the capital economists is a compilation of goods and products that help us generate more. In financial language, it is everything accumulated in money that has not been spent by its owner, in other words, it has been saved and placed in the financial world; This can be through the purchase of shares, acquired goods or public funds, among others, always with the faithful purpose of recovering more than what was invested.

Legally speaking it is the group of rights and assets that are your personal or legal assets.

It is essential to emphasize that capital can be present in various forms as money in the hope that over time it will be feasible to have more, a compilation of producer goods such as a factory. Whatever the case, the main objective of the capital is to leave a profit

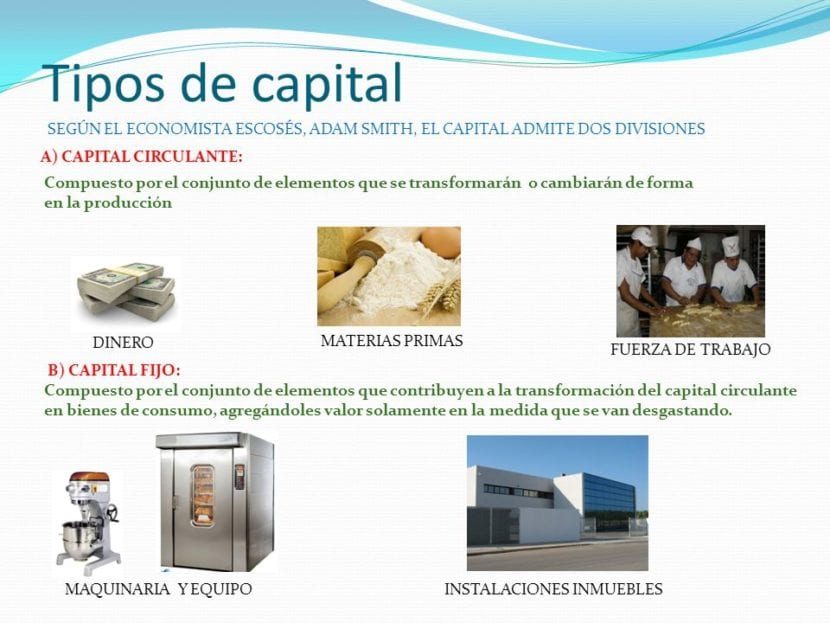

Branches into which the capital is divided

This term is divided into various types of capital.

- Issued capital, which is what a certain company has contributed as part of its actions.

- Fixed capital, It is the one that refers to the goods that companies have as part of their production procedure, it is essential to know that these goods are not used in the short term because they are rather material or in kind.

- Working capitalIt is the opposite of the previous one, in other words, it is the capital that can be spent while the production process is underway but also must be returned in a short period of time.

- Variable capitalIt refers to what is paid, as work, in other words, the salary of an employee.

- Constant capital: It refers to the capital that is invested in materials, machines and other things that are needed to carry out the production process.

- Financial capital. The representation of the value of money that is represented in the total equity of a company is contemplated.

- Private capital, makes mention of private entities or individuals such as companies, organizations and the difference of this is that the decision is intimately linked only to a few members who make it up or who are active members of it for having contributed an amount of money to its creation or in the same way, a percentage of it has been bought in which, therefore, it is worthy of the rights to be able to choose where the decision-making goes.

- Physical capital. It is everything that leads to the facilities and belongings that are used to make the products.

- Floating capitalIt refers to what amounts to what is freely put into shares without having to control it.

- Human capital. It is the set of knowledge, skills and aptitudes that people acquire and that make them capable of carrying out different activities in a productive way without taking into account their level of complexity. The way in which the capital can be increased in this case is through an increase in the payment, whether requested by the employee or when seeing their capabilities, it is granted.

- Risk capitalIt is established as reinvesting the profit that comes from the same shares and is known as capital that lacks profit.

- Social capital. It is the sum of all the items awarded together and that in the long term gives profits what we know as stockholders' equity.

- Natural capitalAre the benefits that one has from the land or the environment, where it is invested so that the environment provides us with a diversity of products in a regulated way to protect it.

- Liquid capitalThis type of capital refers to all the benefits obtained from the company or the economic amount that is derived. What it means is the percentage obtained as a return on the investment. In other words, it provides you with the resources or capital so that it can be used in the operations that suit you best.

- Financial capital, is the set of human, natural, social and manufacturing capital

- Subscribed capital, variable capital that the shareholders agree to give, equivalent to the previous one, in other words, a contribution is given to create capital.

- National capital. It is made up of everything that is produced and carried out in the territory of the country and includes all the money that moves in it, the material goods produced and is a way of specifying the productive capacity of the country.

Today we will focus on talking only about fixed capital which is the one that encompasses everything that is the productive procedure in a company and that degenerates in the long term, such as real estate machines, installations and others.

It is used in the Investment language of European account systems (SEC) which is as already mentioned that it measures through statistics what the real estate and other material things of companies and the government are mainly worth.

There are several classes of companies designated by the general legislation of commercial companies LGSM in which, by way of example, public limited company means that its liability is limited by shares and others; but they can also take the form of variable capital.

Gross fixed capital training

Gross fixed capital training covers the remodeling of the land In other words, such as ditches, drains and fences, the machinery of factories, equipment, buildings, schools, roads and others and others. Obviously you are destined last to the government represented with capital.

It is Gross form of said capital is divided into 3 parts that we show you below:

Gross fixed capital training

They are the resulting assets that are invested in production for more than one year.

This in turn is divided into 2:

- Consumption of fixed capital that it is basically the devaluation of the values of the fixed assets that they own as a result of the simple use or usual wear and tear or when they no longer serve us; This means in economic terms that a part of what is produced is going to be used directly for investment in order to manufacture a large amount of goods and services, even when these goods lose over the months or years. its value when deteriorating. like machinery. Then the consumption of fixed capital will depend on the deterioration time that the goods entail and in such a way the sum of the investment made will decrease.

- The net fixed capital training. It will be this discount that is made by subtracting that consumption from fixed capital. In other words, the gross fixed capital training is what informs us of the value of the resources necessary for investment; In other words, it informs us of the current economy of the changes that have been made.

Related post:

What are assets and liabilities

Stock variability

This is calculated from the difference between the value of the entries and exits in stock that cover the established time and the losses in progress of the goods that are in stock have already been reduced.

They are part of this:

- The materials used.

- Unfinished work such as animals for sale such as livestock and crops and those that have already been completed and will not be modified.

- The purchase and sale but only if it is bought to be sold in this territory of the country.

Mainly what already exists, except for the unfinished work: they are organized by inventories that will be available for a period of no more than one year for the tasks done.

Acquisitions less disposals of valuables. They are those that are not financial, in other words, their main utility is not to produce or they do not devalue over time.

Investing capital is based on giving money in exchange for profits

Those who invest their money to generate higher returns and the more it is invested, obviously, the greater benefit it will have for the future.

It is very important that we emphasize that the capital when invested can have a huge benefit but in the same way it can be against it, because the investments have a risk that in the long term can be possible and beneficial for our investments, but also they may represent a failure by not generating profitable profits.

Therefore, all movements must be well analyzed so that personal and joint decisions are as successful as possible since this will guarantee the success of our decisions, transforming them into more benefits and greater benefits.

Remember that a company or capital with the correct and correctly directed decisions is very attractive in the eyes of the stock market. But if the opposite happens, the gains will be truncated by the bad decisions taken and naturally this will be projected before the Stock Market. These small details will make your capital something successful and you will achieve great benefits in the investment you want to make.

Related post:

Investing in the stock market through fixed income