The Exchange Traded Fund (ETF) on raw materials, are presented as a solution to future contracts. There are ETFs for a vast majority of commodities that are traded on the markets. The problem comes when it comes to selecting which type of ETF is best for us to select. Among the existing variety, we find some that replicate the price through physical, contract, with specific conditions, commissions, etc.

Despite everything, something that is striking is that there are some ETFs that seem to lose value over time. What is the reason for this gradual depreciation? And why do others seem to so faithfully replicate the value they represent? About these phenomena, the types of ETFs that can be found, and a small list of some of them that we can find, is what we are going to talk about in this post.

Types of ETFs that we can find in the commodities market

The commodities market consists mainly of 3 types of categories, metals, energy and agricultural. We can find ETFs that group several assets, a sector, some of them, a particular asset or companies specialized in the production of one or some raw materials. In the event that several assets are grouped, not all have the same weight (percentage) within the ETF, so you have to look at the technical sheet of the ETF in question.

Another question is whether commodity futures have delivery dates or are they listed on an organized market. Depending on the type we touch, such as metals, which are not the same assets such as gold or silver as industrials, they will behave in an ETF differently. Price differences in contracts can lead to some additional costs, or on the contrary, benefits (less common). We are talking here about Contango and Backwardation.

What is contango in an ETF?

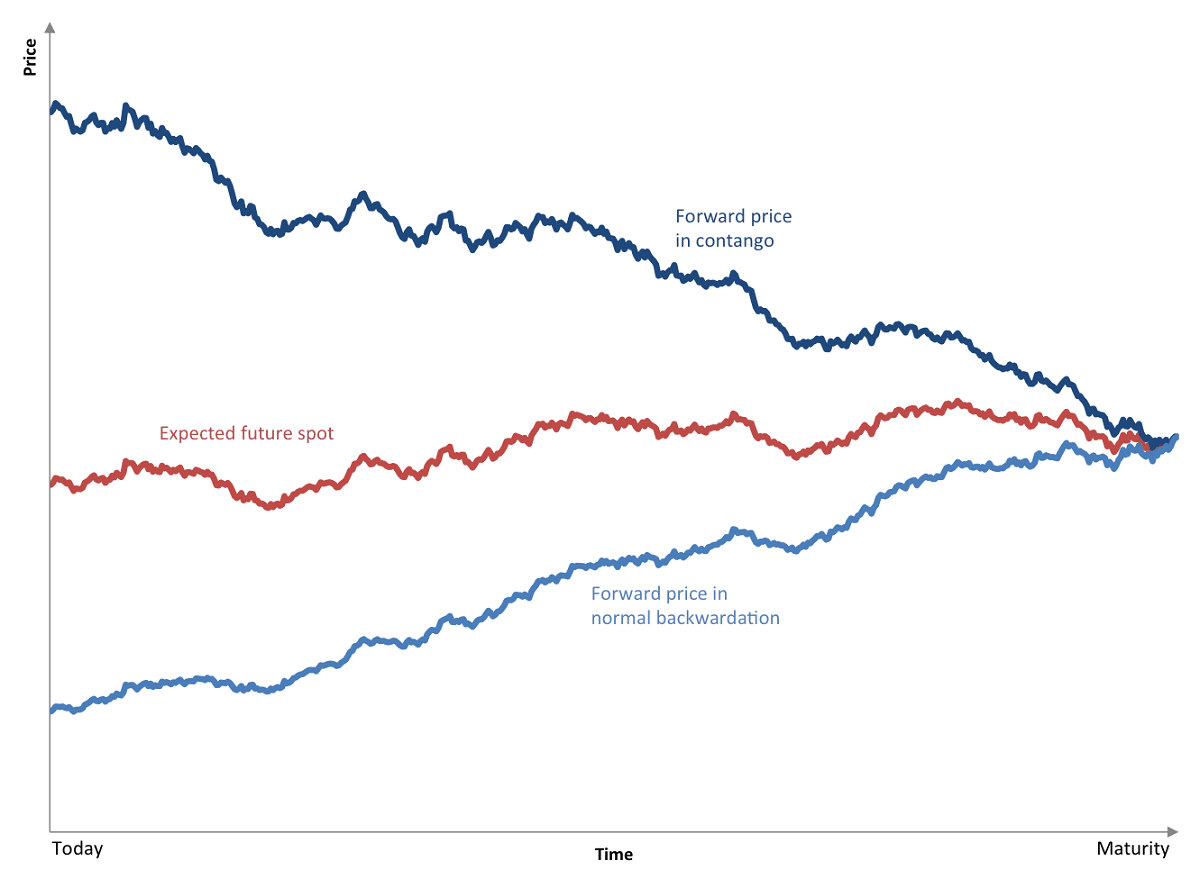

One of the main problems that we can find when investing long-term in some ETF's is that of deferral of payment. This "loss of value" situation occurs when the asset's spot price, in other words, the immediate delivery price, is lower than the asset's future price. This happens when investors expect the price of the asset to remain stable or even increase in the future. In the futures market, an upward price difference is found in the following contracts when this situation occurs. This phenomenon is motivated by the reserves of the raw material, in which the costs of inventory, storage and interest not received when investing the goods are considered.

If you are investing directly in the futures market, continuing with open 'long positions' could be accomplished by 'signing up'. In other words, give the current future contract and take another future with the respective price difference, assuming the difference (loss) in value. In the case of ETFs, this apparent loss in value would be caused by this same phenomenon, causing their price to fall in the long term.

The opposite situation to contango would be the backward one. When the current price of the future delivery is higher than the price of the underlying asset. In spite of everything, the normal thing in the market is that contango occurs, rather than backwardation.

Differences between ETFs and the assets they replicate

Even though it has been previously commented on the effect of contango and the loss of value, not all ETFs on the same asset are replicated in the same way. To establish which is the best ETF for an asset, we must compare its correlation with that of the underlying asset. The ETFs that best replicate the behavior will also be the most interesting. At the same time, however, we must pay attention that not all assets act in the same way. For this, we will see some examples.

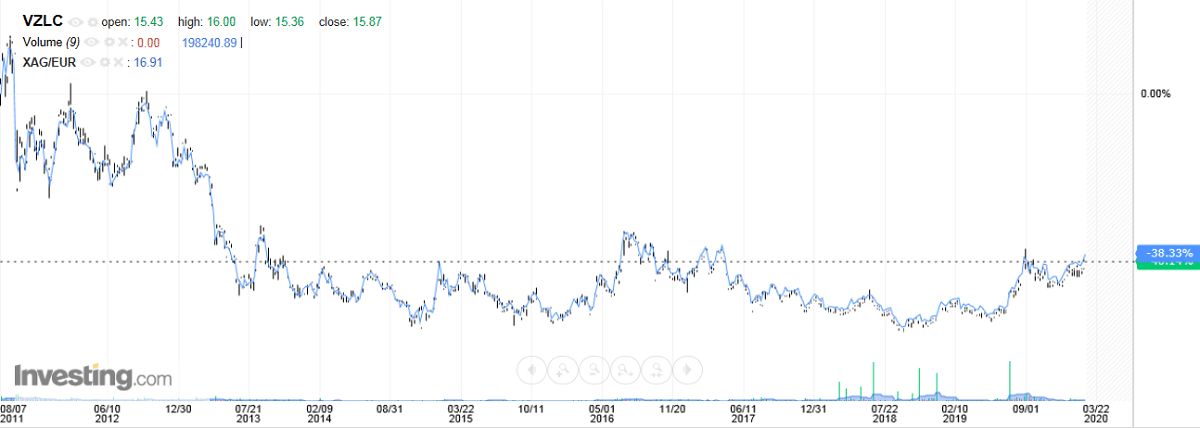

In the case of silver, we can observe the behavior of an ETF that faithfully replicates the behavior of the asset it represents. Is about WisdomTree Physics Silver. It is designed for investors looking for the same return as the asset that represents less the expenses derived from an ETF, which are generally very low. For this case, we can find other metals such as gold, which, due to their characteristics, can be 100% replicable.

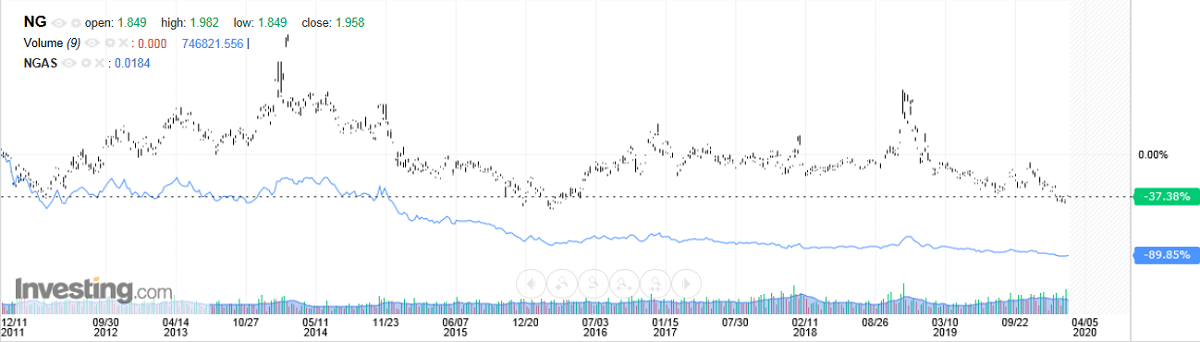

For other cases, the contango effect is inevitable. We can find it in the mentioned case, Gas. Although the underlying has lost 37% of its value compared to approximately 8 years ago, the contango effect, for the reasons specified previously, has caused a reduction of almost 90% in a replicating ETF.

This means that we should always look for the correlation between the ETF and the commodity what we are interested in. And it is that depending on its nature, we can opt for longer-term investments or other short-term and fast movements. Contango, then, becomes a trap to remain trapped in the long term if you don't get benefits from short-term walks.

List of some ETFs to invest in commodities

With the following list, you can see that there are truly many ways and means to invest in commodities. Everything will depend in the end, according to our exhibition preferences. But to get an idea, the following are an example of what we can find:

- Petroleum. The United States Petroleum Fund It is an ETF that tries to replicate the price of oil (taking into account the expiration prices, and deferring them each month, the contango effect occurs, as an example).

- Platinum. The Physical Platinum ETF by WisdomTree faithfully reproduces the behavior of platinum. On its web portal you can find many other ETFs whose prices are very close to other metals.

- Wheat. The Weat ETF It is focused on replicating the price of wheat, with the respective contango.

- Copper. The Global X copper miners is an ETF that tracks the Solactive Gobal Copper Miners Total Return Index. Compared to other commodity ETFs, this one takes advantage of volatility by investing directly in mining companies, also offering a dividend payment.

- Agricultural. The Panda Agriculture and Water Fund is an ETF referenced by the S&P Global Agribusiness Index and the S&P Global Water Index. Invest in agricultural and consumer companies, with a very valuable focus. It is also an ETF that incorporates the water sector.