<>

Not all of us have the same preferences when it comes to selecting actions. And that is why we are going to talk about Stock Screeners, also called Stock Screeners. One of the most powerful tools that allow you not to wander through the great ocean of the world of actions. And, who has not found themselves in the situation of not knowing or cannot think about where to invest? Especially in times of economic uncertainty, or when it is not known which company can be better in a sector.

Many millionaires have made their fortune by filtering and being very selective a la hora de seleccionar las acciones de una compañía. Fundamentalmente por no dejarse llevar por corazonadas, y tener criterios objetivos a su disposición. Debido a que no hay nada más target que la parte numérica en las inversiones. Si como inversor además te preocupa asegurarte de hallar esa compañía que cumpla con todos los criterios que consideras indispensables, entonces este post es de tu interés.

What is a stock appraiser?

The filters de acciones son las herramientas que los inversores pueden usar para seleccionar acciones específicas. entre los cientos que se pueden hallar. Todo ello, en base a los criterios y selecciones que los usuarios (inversores) dan mayor relevance. Dependiendo de las funcionalidades o plataformas que los hayan creado, los stock screeners se pueden hallar en la Web desde versiones gratuitas más fáciles hasta algunas de pago (regularmente algo más elaboradas).

Among the most common preferences or selections, we can find different filters algunos de los cuales definen un PER (Price to Earning Ratio) que hemos indicado, el volumen de capitalización de mercado, la región en la que preferimos que cotice la compañía, el volumen promedio negociado, el sector entre el que se prefiere buscar, otros, varios ratios, etc. Algunas de estas plataformas y software posibilitan a los usuarios realizar una pantalla usando indicadores técnicos. Algunos tan habituales como el RSI (Relative Strength Index) o medias móviles a 50, 100 o 200 días, según los criterios que la persona siempre haya escogido anteriormente.

The main advantage of Stock Screeners, beyond allowing us to filter and go directly to the actions that interest us, is the optimization of personal time. In the past, many investors had to read the extensive guides (hundreds of pages) that were published annually presenting the financial statements of companies. Today would be enough for us a short time to go directly to those actions that meet the criteria we are looking for. And if it is a question of shortening the time, let's see some of the Stock Market Screeners that we can find on the net.

The best stock screeners

On the web we can find a great variety of Stock Screeners. Each of us, as investors, has our preferences when it comes to selecting stocks. For this same reason, we are going to see some of the types of Stock Screeners that could be interesting in our operations. Some of which are specialized in countries, in number of companies, or from parameters more focused on technical analysis.

Investing.com - Quick and easy

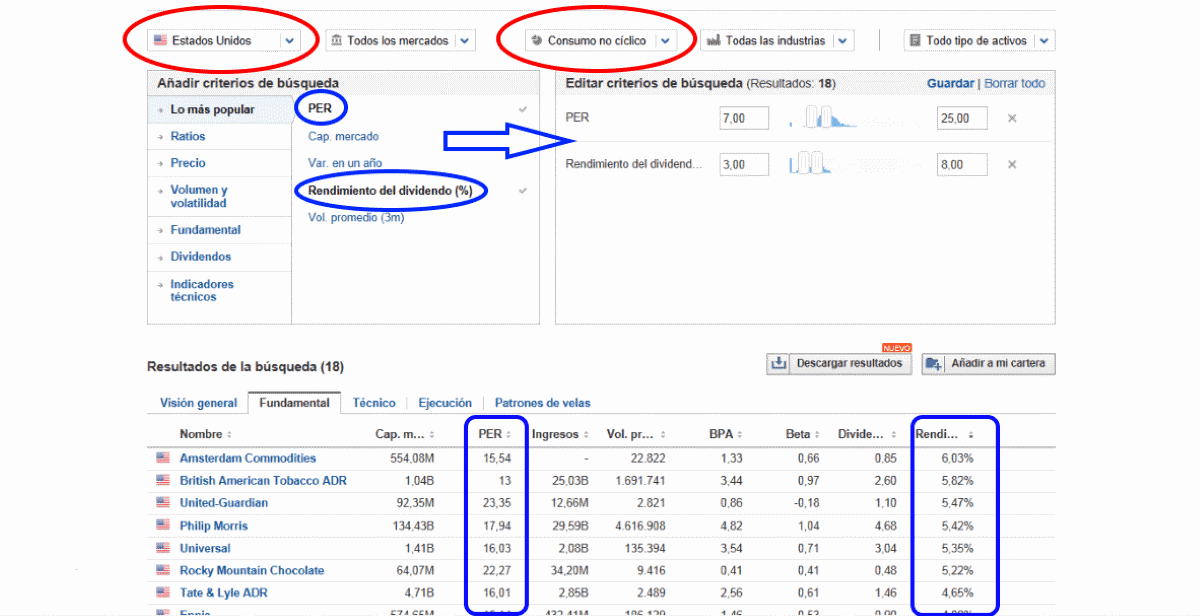

My favorite, and that is why in the first place, it is the one that I use the most personally. The bag filter investing.com offers us a quick and easy platform to find and evaluate actions within its interface. In the demo example in the image, I wanted to capture a typical result after applying some filters. In this circumstance, look for non-cyclical consumer companies in the United States, and that trade at a PER between 7 and 25 and annual dividends with a profitability between 3% and 8%. You can see in the lower part of the image the 18 results found, in which for this case I have ordered from highest to lowest dividend.

Among its filters to apply we would find:

- Ratios: The typical ratios between the Price in relation to Sales, Cash Flows, Earnings per Share as well as Asset Turnover, Income and Net Profits per Employee, among others.

- Price: In connection with the quotation. Between its maximum and minimum of the last year, variations, in percentages, and even monthly and daily.

- Arguments: Solvency Ratio, Annual and 5-Year Net Profit Margins, Acid Test, Market Capitalization….

- Dividend: From yield to dividend growth rate, as well as payment (percentage of net earnings to be distributed).

- Technical indicators: The above, and widely used in graphical (technical) analysis. We find filters for RSI, ROC, MACD, ATR, Williams ...

WallueStreet - For the Spanish investor

WallueStreet presents us with the opportunity of a screener in the Spanish Stock Exchange and the analysis of companies that compose it (in addition to the Continuous Market). It is for all those who are interested in investing in the Spanish market and want a fast and super easy to use tool. At the same time as being able to select the actions yourself, in the menu on the left, «Suggested filters», we can see already predetermined sieves.

In the image of this example, you can see the selection of Dividend Aristocrats. Look for companies with good business quality, with steady growth and growing dividends over the years. If you did not know how to find them, the same platform provides you with the filters that you must select for use.

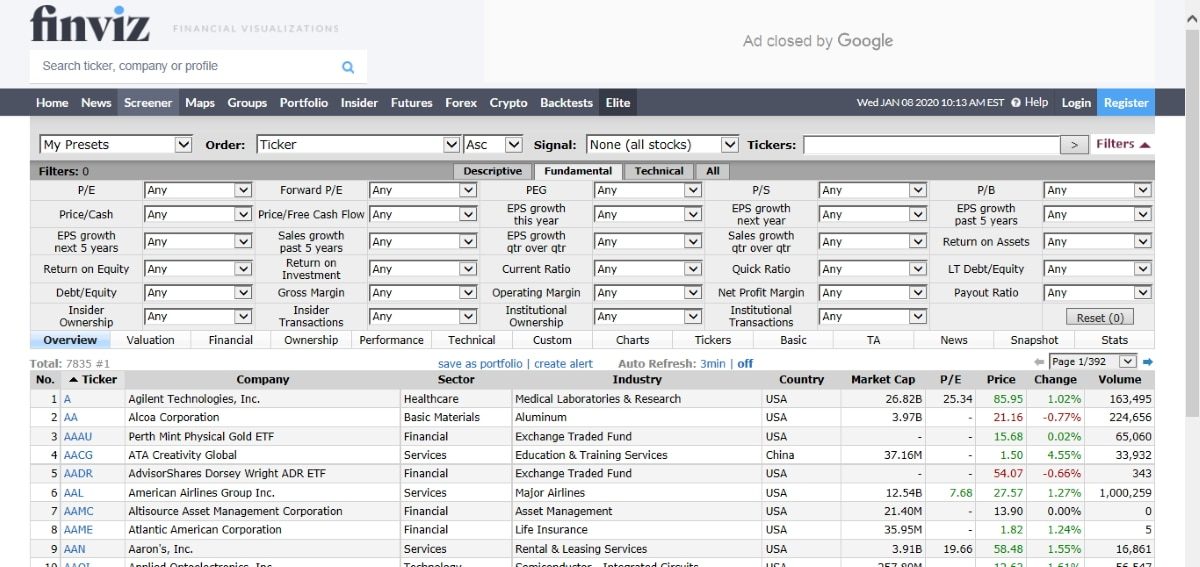

Finviz - For the most demanding

Finviz is surely one of the most complete screeners that we will find on the net. There are many filters, in the image you can see all the opportunities about the "fundamental" filters that can be applied. From annual earnings per share, to recent years, as well as future forecasts, including internal movements! On the other hand, we have the typical descriptive filters depending on the type of company we are looking for and where, but that is not why it is easier. And to finish we can also find filters for the technical chapter, with the respective moving averages, volatilities, RSI and even Gap's.

A truly complete platform, that even when we know that there is no ideal stock screener, will not leave you indifferent.

On the web, there are many otras páginas para revisores de valores. A modo de ejemplo, Yahoo! or Google Finance In their interfaces dedicated to the stock exchanges you will find services that they have added. The most notable advantages they offer in these cases is that they cover a large number of companies. "Low-capital" companies can be found in remote regions and are traded attractively as they are unfamiliar, which can offer great potential for the most finicky investors. All this, with the opportunity to screen the actions that are chosen according to the indicated parameters.