What is swing trading?

Swing trading is known in the world of economics as one of the strategies or practices with which it operates in many financial markets. The practice is to buy or trade very close to the end of the price swing depending on this go up or down. These changes, the causes volatility of the same and is created on a daily basis including weekly with reference to the price.

East type of operations that are given how to swing tradingThey are usually open for more than a day, despite all the extension of this type of practice has a shorter duration than those found within the trends. They also last less than strategies that involve buying and holding. The latter are the strategies in which the person who wants to invest buys any product in stock so that the price rises in the long term. This can vary from days to weeks or even years.

Market operations and swing trading

Most people who use swing trading know that it is a style of economy to operate in the market and through which are obtained winnings with a total of up to 4 days maximum. People who want to carry out this type of method carry out a technical analysis with a short price system medium term through which many people take the opportunity to get a plus of money in a short time.

When they buy the product, the merchants are not interested in the value of the product at that moment, but in the price trend and market patterns between 1 and 4 days.

People who are dedicated to swing trading are experts in establishing any exchange rate in prices and be attentive to the fluctuations that occur and which are the most sought after products. These types of predictions focus on people's optimism towards a certain market and the declines observed in recent days in other products. Sometimes he good traders keep an eye on those products for months and the benefits in these types of techniques are seen to rise and fall.

Swing trading methods

Market Predictive Trading Systems They focus on an intense and long analysis in order to establish what are the entry prices of a product and the exit prices of the same. And what is more, traders must know the stop loss price that is used to operate in the markets.

Everyone trading algorithms are not exclusive to swing trading, These traders also use day trading and rarely use long-term trading.

The algorithms of the merchants, is the most reliable system They have to be able to make decisions about one method or another. Most of them have been economically driven by large banking firms and tens of millions have been spent to improve such algorithms. This is something that worries banks a lot, since through algorithms a more stable market can be achieved and, above all, much more efficient for everyone.

Actually, the goal of algorithms is to erase the weight of the decisions that are made by traders and start operating in a totally efficient way with the lower risk of failure. Most of the traders you can hire today, including traders who have been in the market for years and are professionals, carry out many processes by simple intuition.

What are the most common swing trading techniques?

The techniques to be able to swing trading focus as we have already said on the intuition of the trades, Despite everything, there are several indicators that help us know when is the right time and in which products they should be. One of the most popular are pivot points, These are given on a daily or weekly basis in many of its variants.

Another of the indicators is the price action along with the wave measurements and above all, the trend indicators.

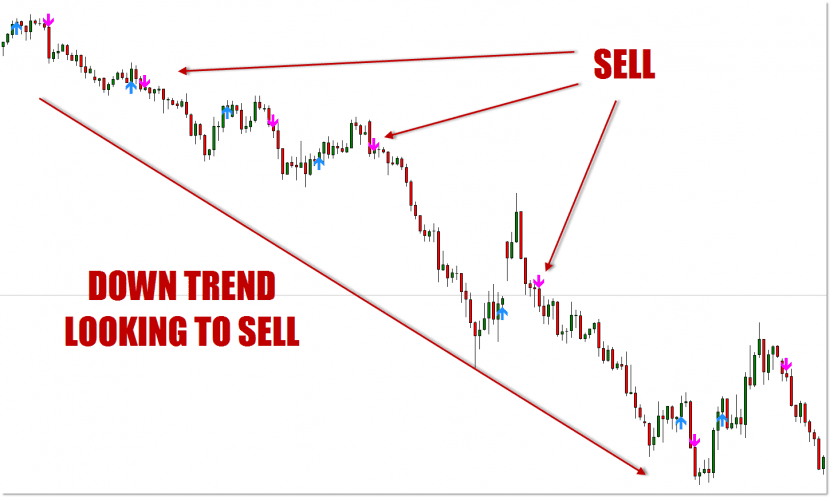

Swing traders have the strong movements in trends and they notice that it moves people impulsively. For swing trading techniques, you never tend to go against trends and always use the momentum indicators. These indicators are responsible for establishing the strength of each movement and is one of the the best tools for swing traders.

When preparing a good swing traders strategy, Traders must present a series of active charts by means of which it is feasible to trade at three different points that traders must master in order to know which product is best for them.

How long does a typical swing trading move last?

To know how long a movement of scam trading, you must know what trend you are going to climb. Regardless of which one you are performing for your method. What's more It depends a lot on the time you enter, since it is not the same to enter a trend when it is starting, than to enter when it is almost finished. The gain is directly dependent on the merchant skill.

Basic tips for your fraudulent business movements

Narrow sails

One of the first recommendations from the experts for people who are new to the scam trade, they are the candles. When we look at candles on especially large charts, it tells us about a critical moment of the product. A lot of attention must be paid in these cases, as the market is driving out buyers and sellers and it is likely that at the end of this procedure, the result will be reversed.

If you are starting your journey by Scam trading, you should know at 100% the behavior of the candles and their different patterns.

When the candle ranges are made up of narrow candles this indicates explosive movements of the product. This is what is often called, the calm before the storm.

If you are not a Even as a candle expert, you can apply the 50% rule while learning.

In this circumstance, you must wait for the penetrating or engulfing pattern to pass. It is when the center point of a candle exceeds 50% of the total of the candle.

There are many patterns in candlestick analysis They are confirmed when the close of the current candle exceeds the center point of the body of the previous candle. Therefore, when the market is correcting a previous uptrend, if you expect to see a candle that closes above at least the center point of the previous candle's body, (50% of the previous candle's body), there are high odds. that a "Piercing" or "Engulfing" type pattern is forming, which has bullish overtones.

This rule should be of help to all those who have not yet delved into the learn candlestick chart patterns. But I suggest that you gradually incorporate this knowledge into your battery of tools, if you are going to focus your operative for swing trading.

On the other hand, the candles that can be seen in the form of a window should attract your full attention because they are very important, especially for people who are starting their journey in the world of swing trading.

Yes checking your charts, suddenly you meet a gap or gap with a clearly descending trendIt means that the behavior is controlled by the supply, in other words, the selling party; This occurs due to various factors, such as when goods, products or services are provided on a limited basis.

On the other hand, if within the same session it happens that the gap closes with an uptrend As for the point at which the gap was opened, what is called a bearish gap, for example, because control is reversed, then what is known as a white candle is obtained.

Another important indicator is usually the swings depth. When showing a clear downward or upward trend, a good way to tell if you are opening a trend reversal is by exactly measuring the depth of these changes. As a general rule, if the swings occur in small jumps, in other words, do not exceed the 50% of the previous impulsive stage, it will be very difficult for the trend to reverse. In other words, if it was originally up and the swings are most likely small, the uptrend will continue.